NOTICE OF Council

MEETING

PUBLIC AGENDA

An Ordinary Meeting of City of Parramatta Council will

be held in PHIVE (COUNCIL CHAMBER) AT 5 PARRAMATTA SQUARE, PARRAMATTA on Monday,

24 July 2023 at 6:30PM.

Gail Connolly PSM

CHIEF EXECUTIVE OFFICER

STATEMENT OF ETHICAL OBLIGATIONS:

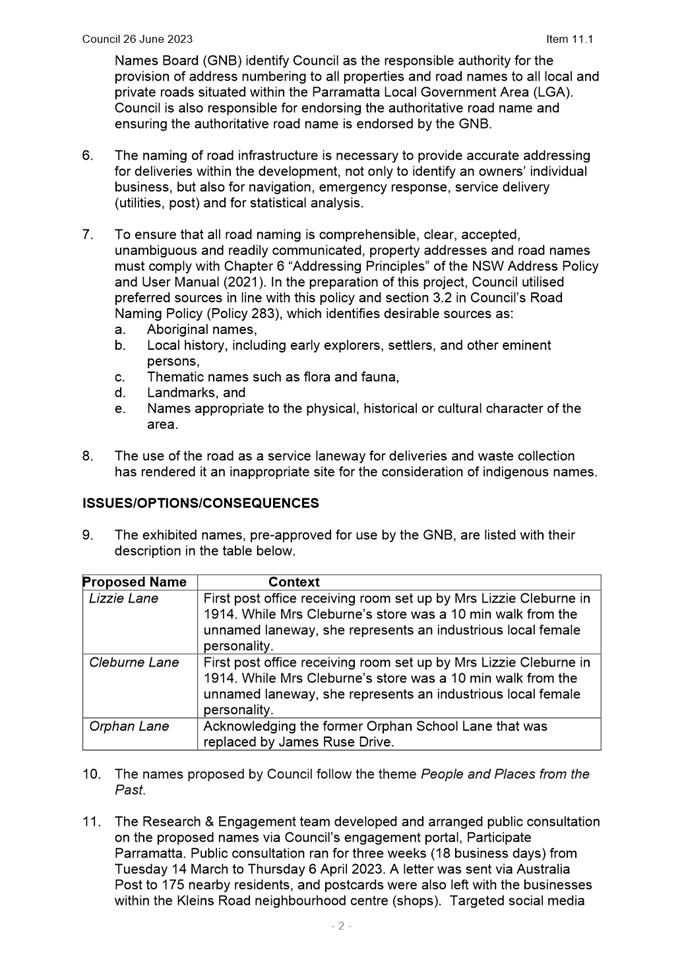

In accordance

with clause 3.23 of the Model Code of Meeting Practice, Council is obligated to

remind Councillors of the oath or affirmation of office made under section 233A

of the Local Government Act 1993, and of their obligations under

Council’s Code of Conduct to disclose and appropriately manage conflicts

of interest – the ethical obligations of which are outlined below:

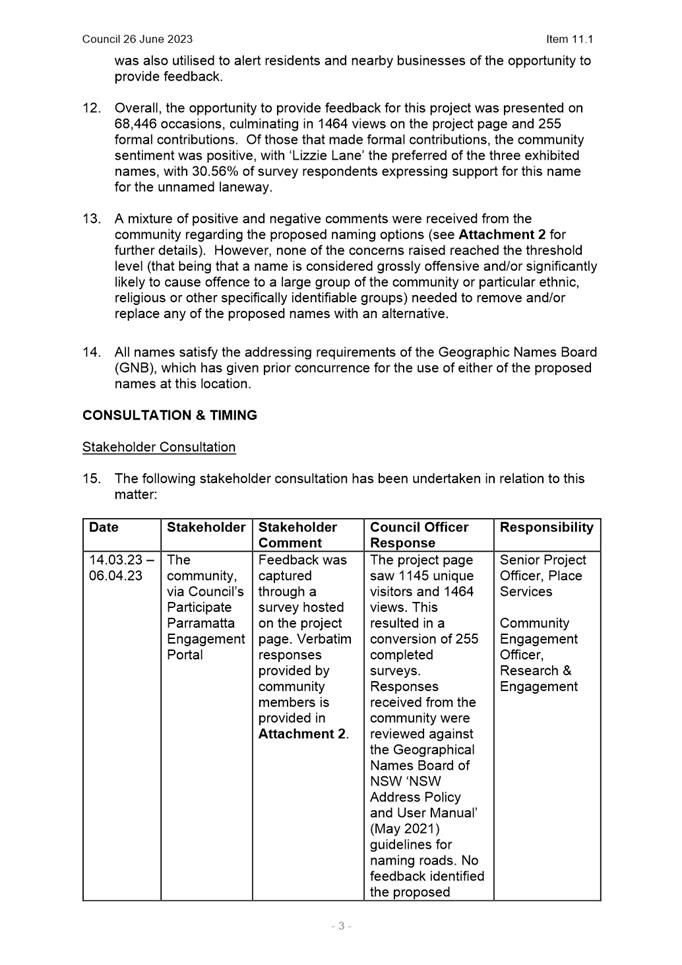

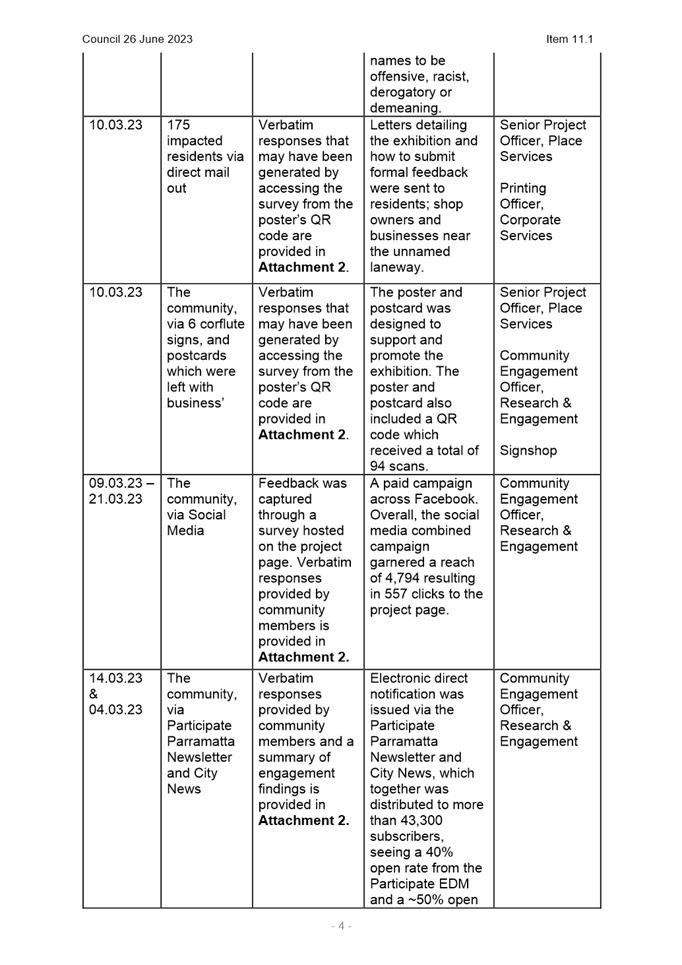

|

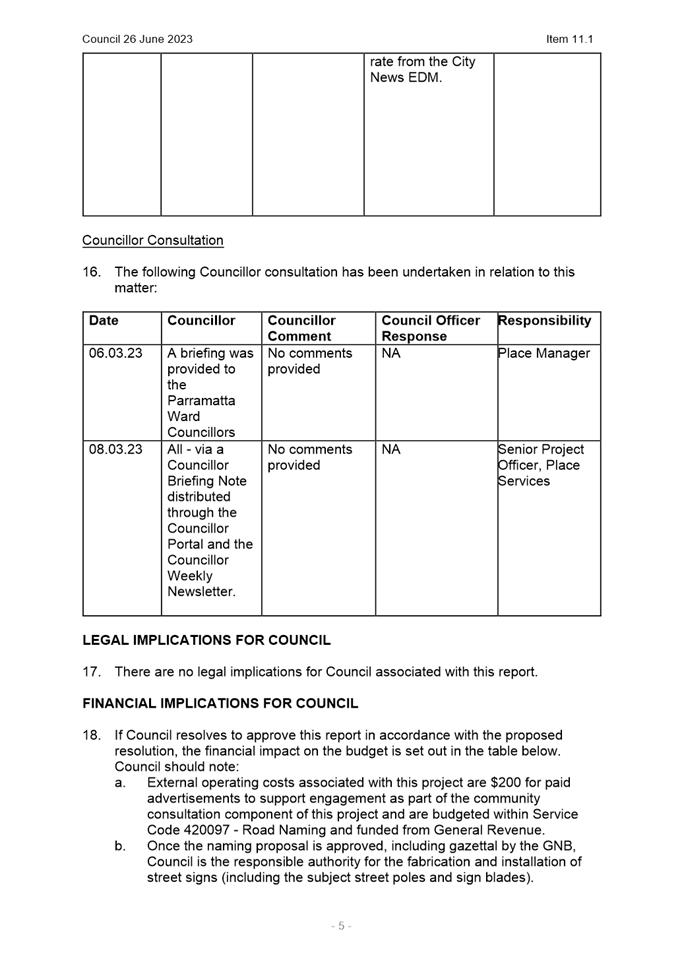

Obligations

|

|

Oath

[Affirmation] of Office by Councillors

|

I

swear [solemnly and sincerely declare and affirm] that I will undertake the

duties of the office of Councillor in the best interests of the people of the

City of Parramatta Council and the City of Parramatta Council that I will

faithfully and impartially carry out the functions, powers, authorities and

discretions vested in me under the Local Government Act 1993 or any other Act

to the best of my ability and judgement.

|

|

Code

of Conduct Conflict of Interests

|

|

Pecuniary

Interests

|

A

Councillor who has a pecuniary interest in any matter with which the

Council is concerned, and who is present at a meeting of the Council at which

the matter is being considered, must disclose the nature of the interest to the

meeting.

The

Councillor must not be present at, or in sight of, the meeting:

a) At any time during

which the matter is being considered or discussed, or

b) At any time during

which the Council is voting on any question in relation to the matter.

|

|

Non-Pecuniary

Conflict of Interests

|

A

Councillor who has a non-pecuniary conflict of interest in a matter,

must disclose the relevant private interest in relation to the matter fully

and on each occasion on which the non-pecuniary conflict of interest arises

in relation to the matter.

|

|

Significant

Non-Pecuniary Conflict of Interests

|

A

Councillor who has a significant non-pecuniary conflict of interest in

relation to a matter under consideration at a Council meeting, must manage

the conflict of interest as if they had a pecuniary interest in the matter.

|

|

Non-Significant

Non-Pecuniary Interests

|

A

Councillor who determines that they have a non-pecuniary conflict of interest

in a matter that is not significant and does not require further

action, when disclosing the interest must also explain why conflict of

interest is not significant and does not require further action in the

circumstances.

|

TABLE OF CONTENTS

1 OPENING

MEETING

2 ACKNOWLEDGMENT

OF TRADITIONAL OWNERS OF LAND

3 WEBCASTING

ANNOUNCEMENT

4 GENERAL

RECORDING OF MEETING ANOUNCEMENT

5 APOLOGIES

AND APPLICATIONS FOR LEAVE OF ABSENCE OR ATTENDANCE BY AUDIO-VISUAL LINK BY

COUNCILLORS

6 CONFIRMATIONS

OF MINUTES

Council - 10

July 2023................................................................................................ 7

7 DECLARATIONS

OF INTEREST

8 Minutes of the Lord Mayor

9 Public Forum

10 Petitions

11 Rescission Motions

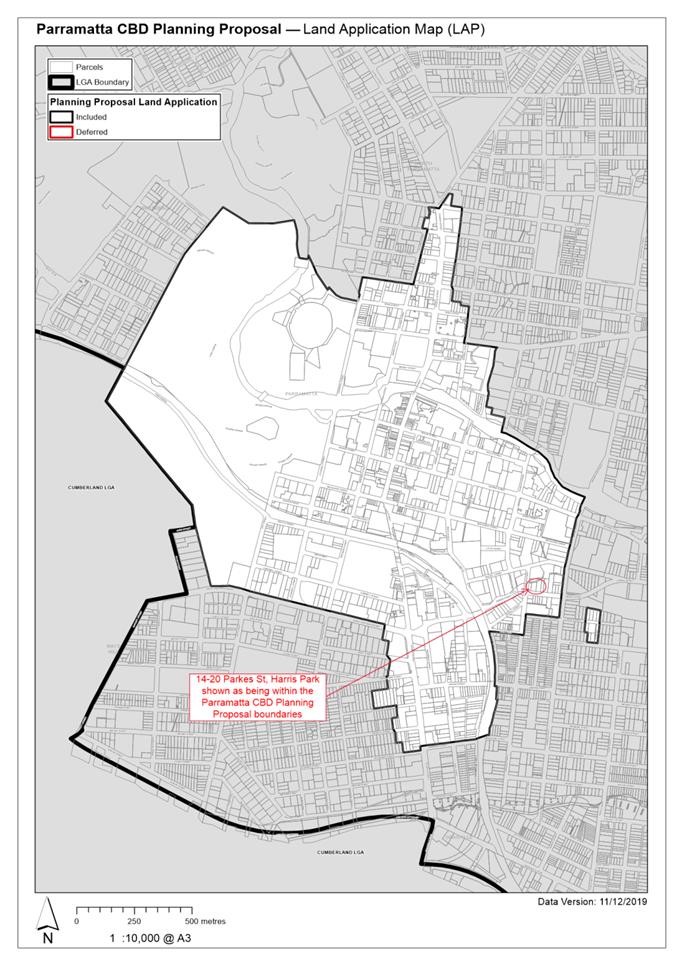

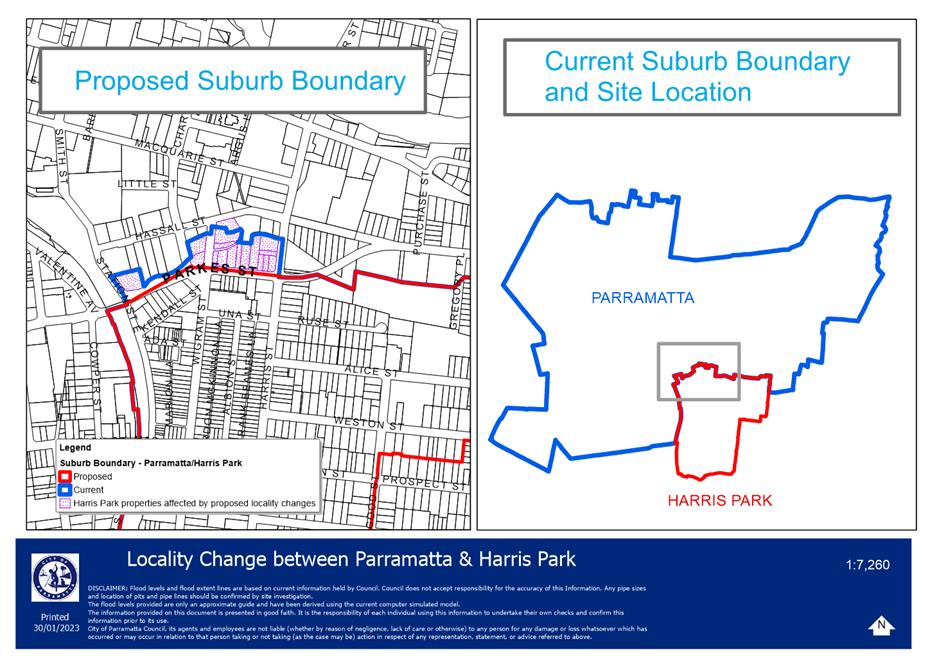

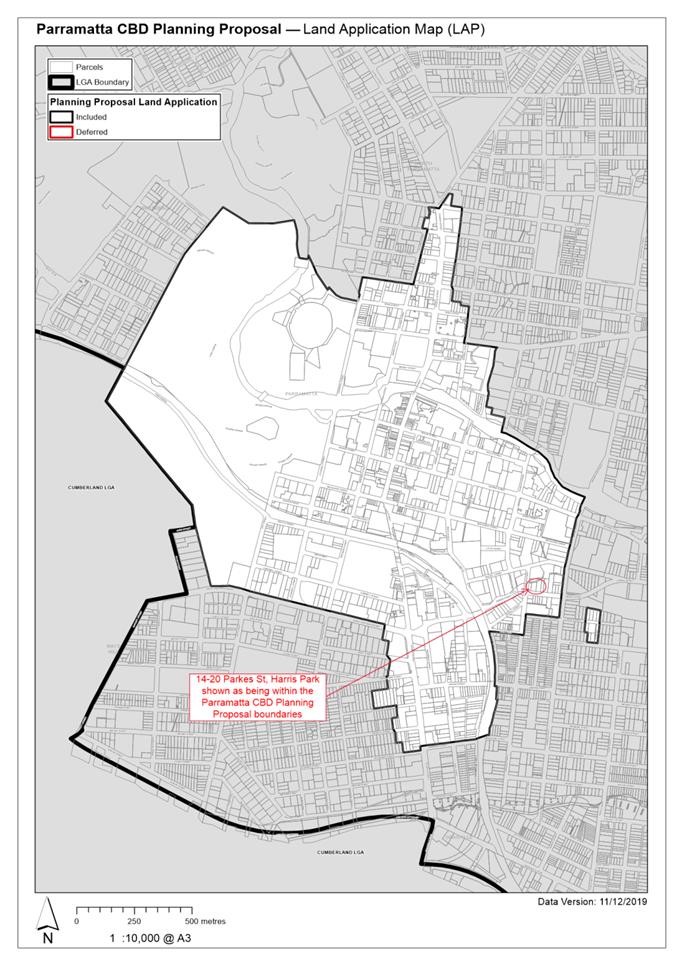

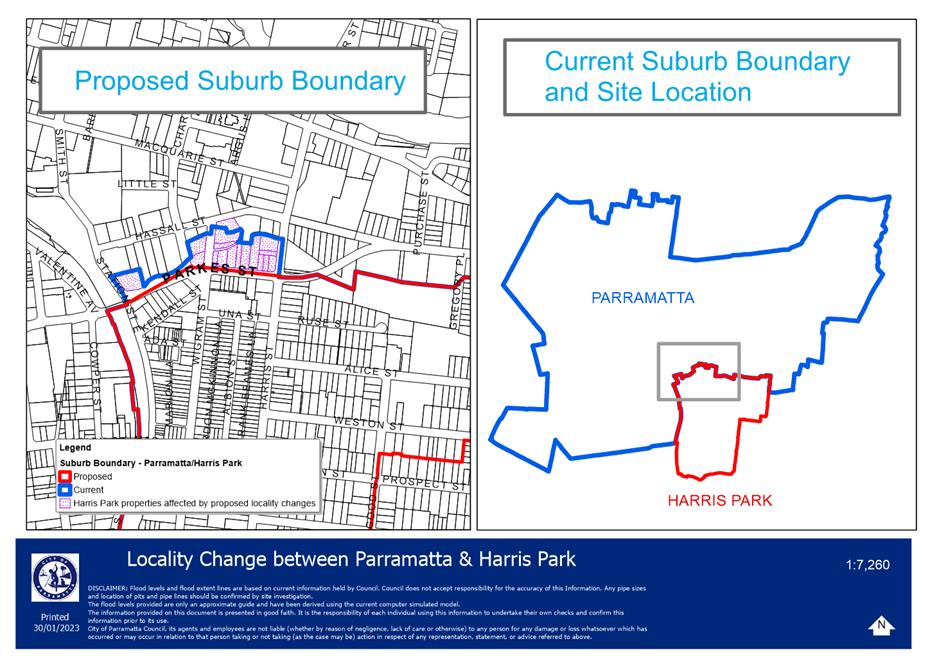

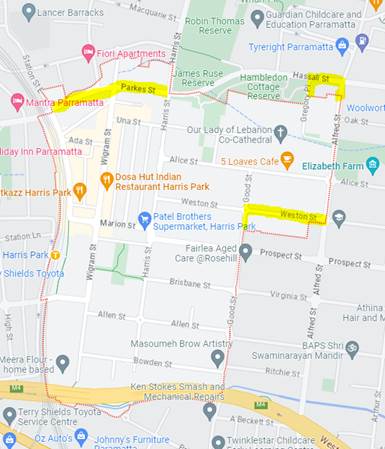

11.1 DEFERRED

from OCM 26 June 2023

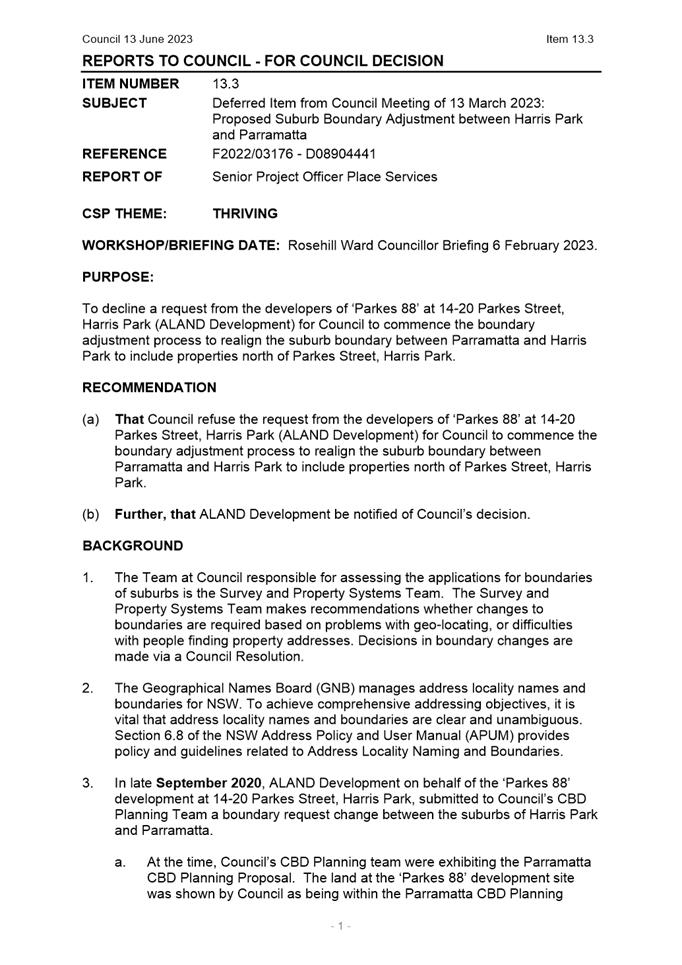

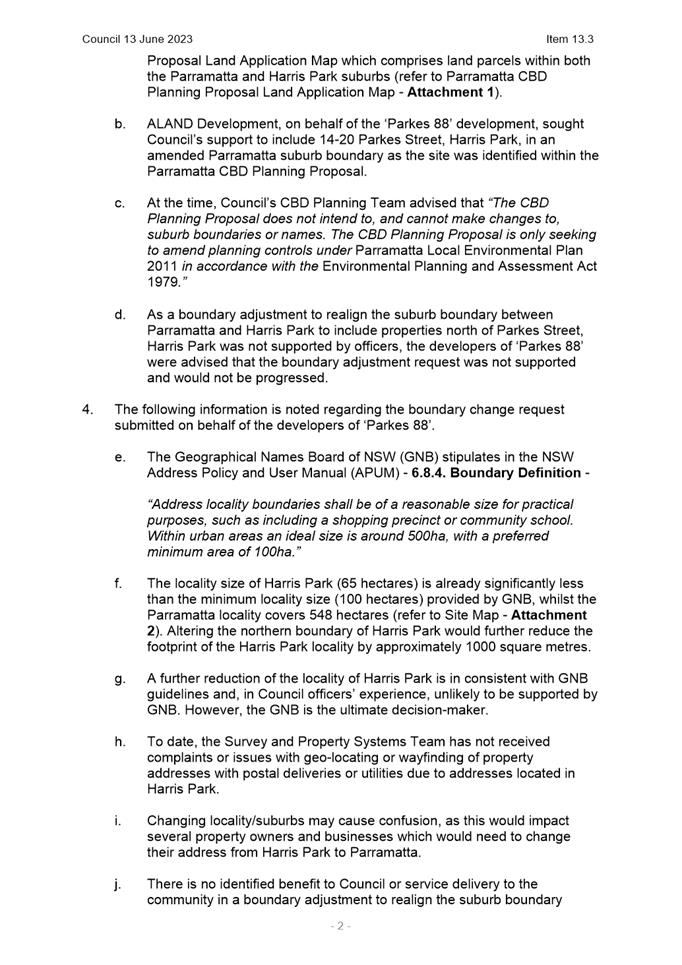

Notice of Motion of Rescission: Item 11.1: Proposed Suburb Boundary Adjustment

between Harris Park and Parramatta (Item 13.3 from Ordinary Council Meeting of

13 June 2023)....................................................... 42

11.2 Notice

of Motion of Rescission: Item 13.7 Results of Community Consultation Popular

Election of Lord Mayor and Referendum Question (from OCM 10 July 2023 )..................................................................... 51

12 Reports to Council -

For Notation

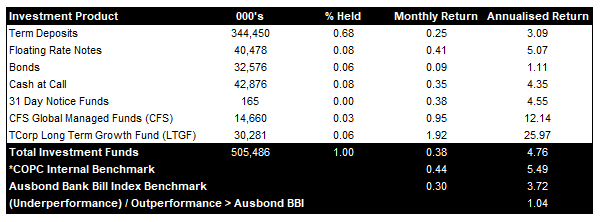

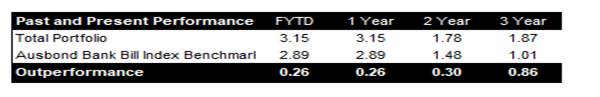

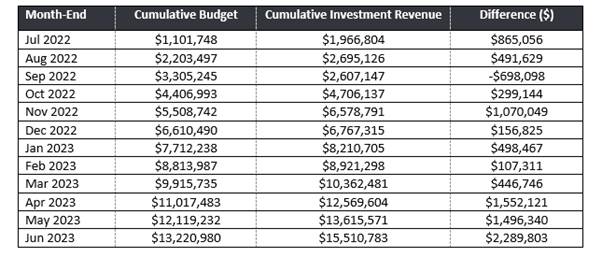

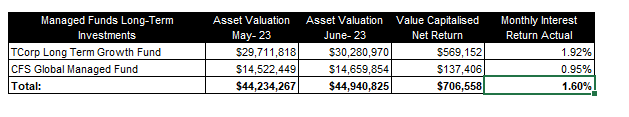

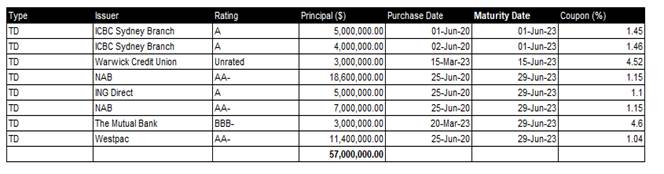

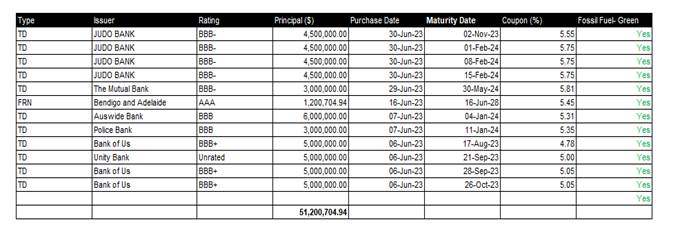

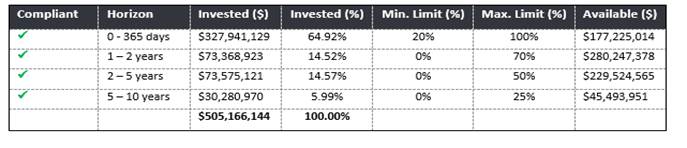

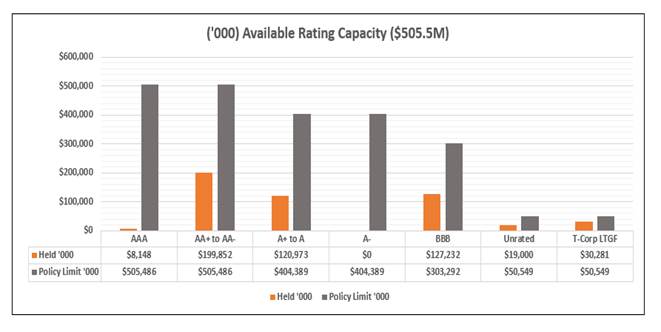

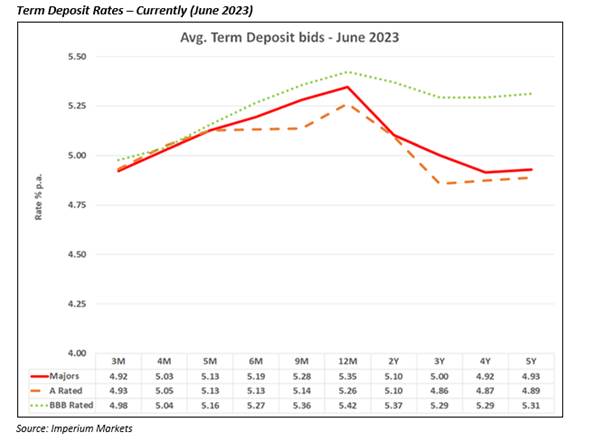

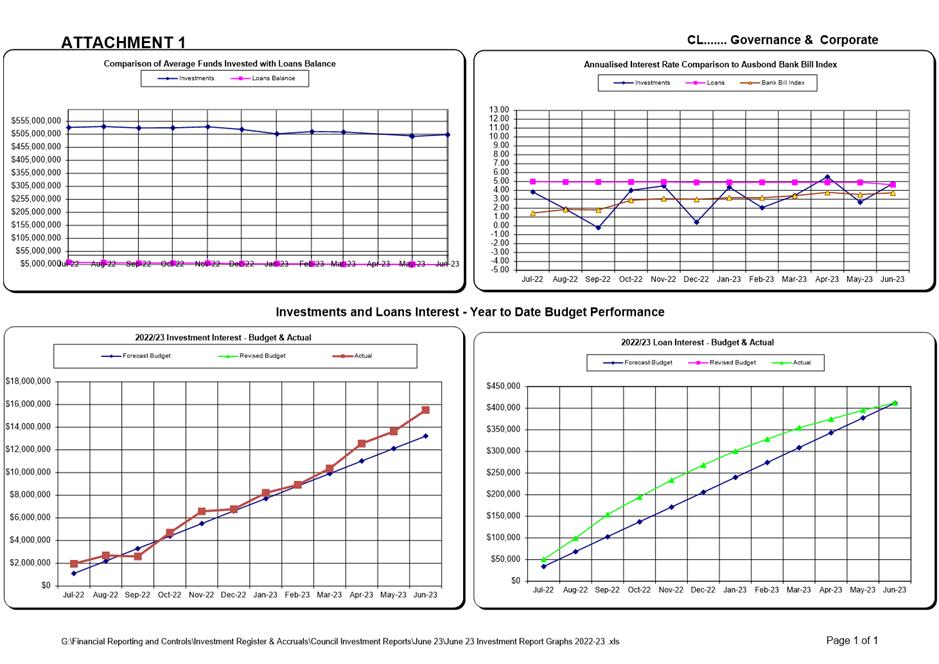

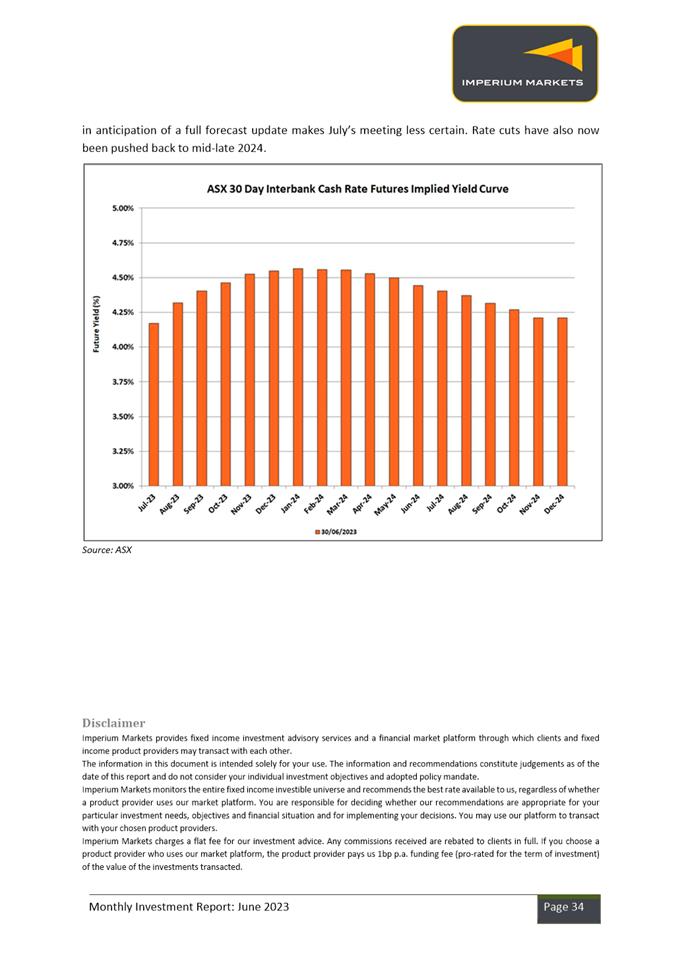

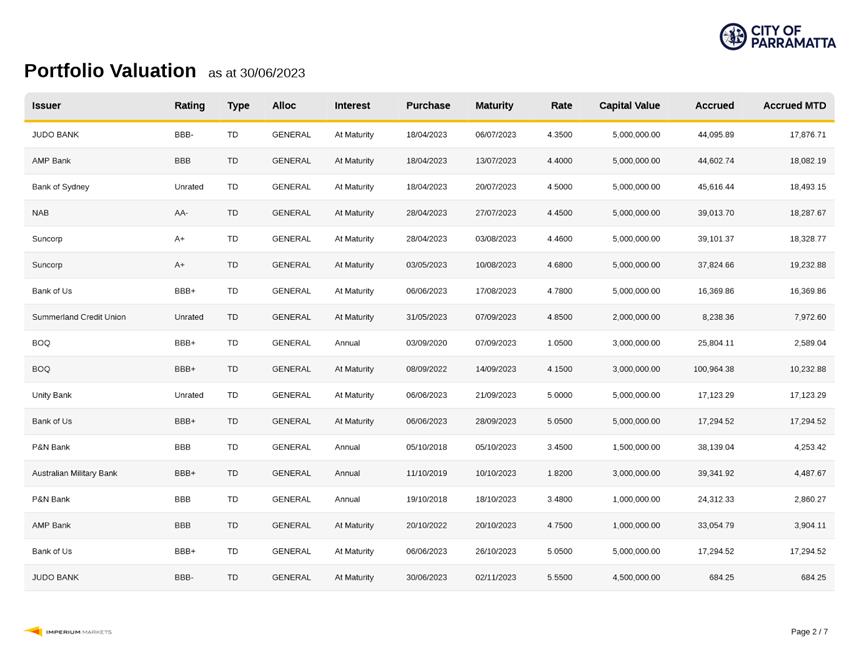

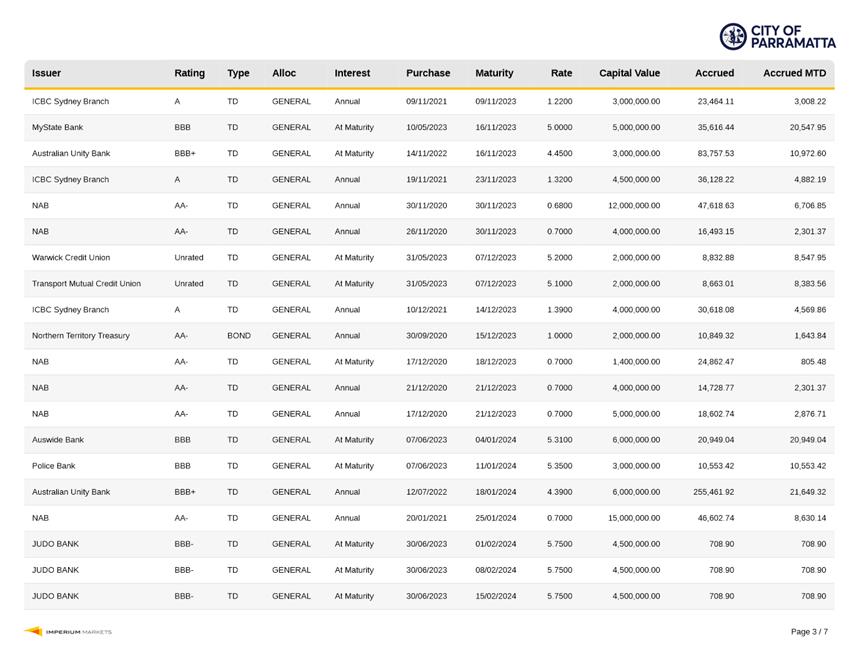

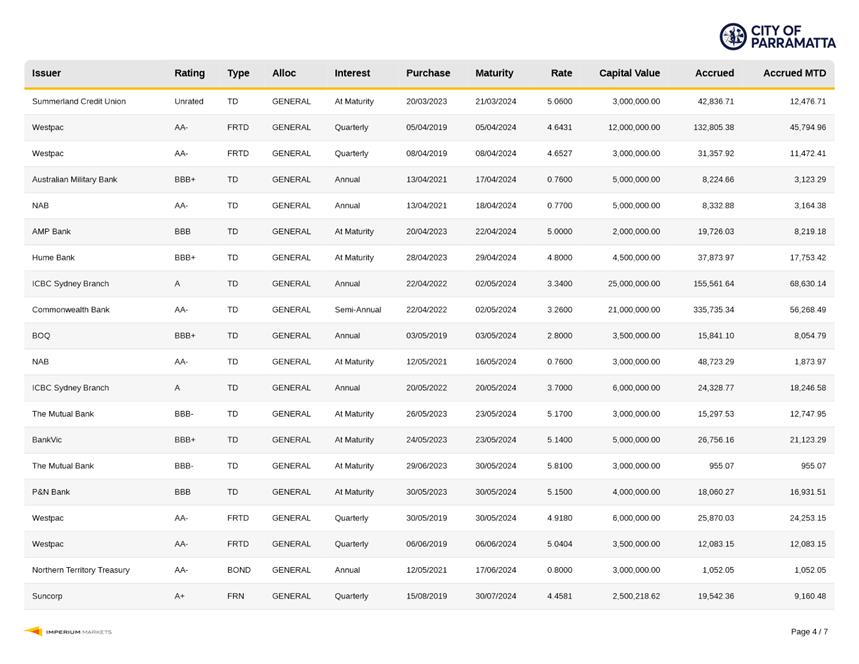

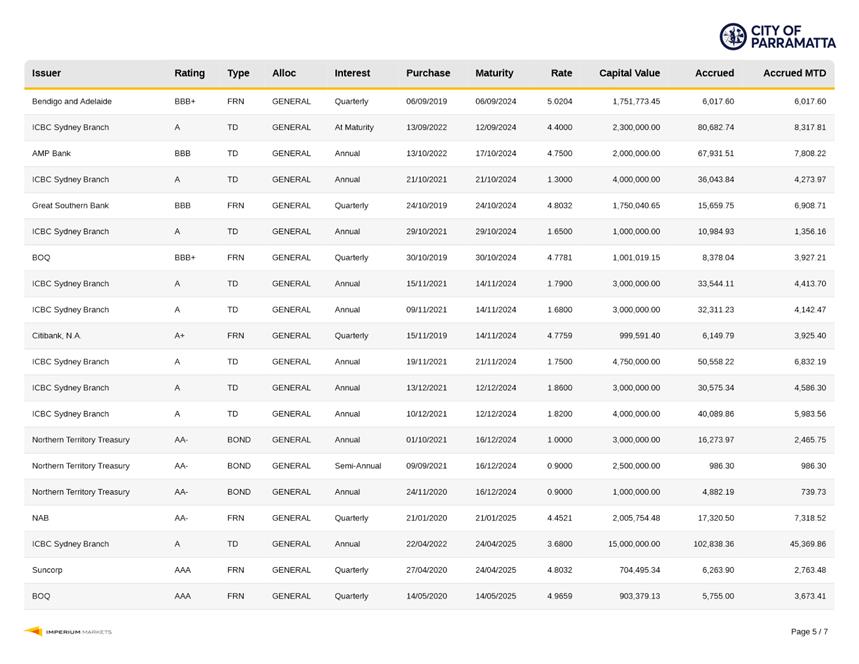

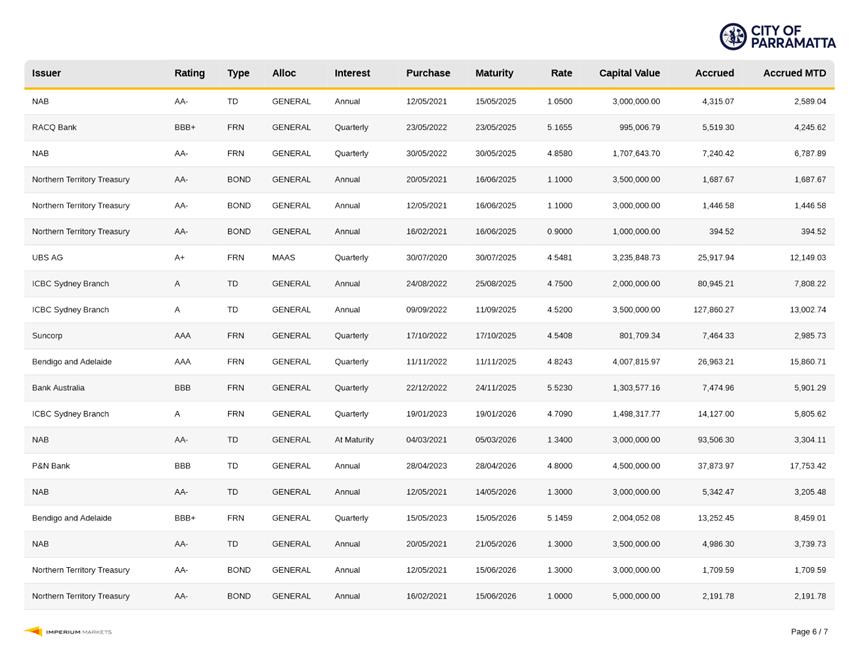

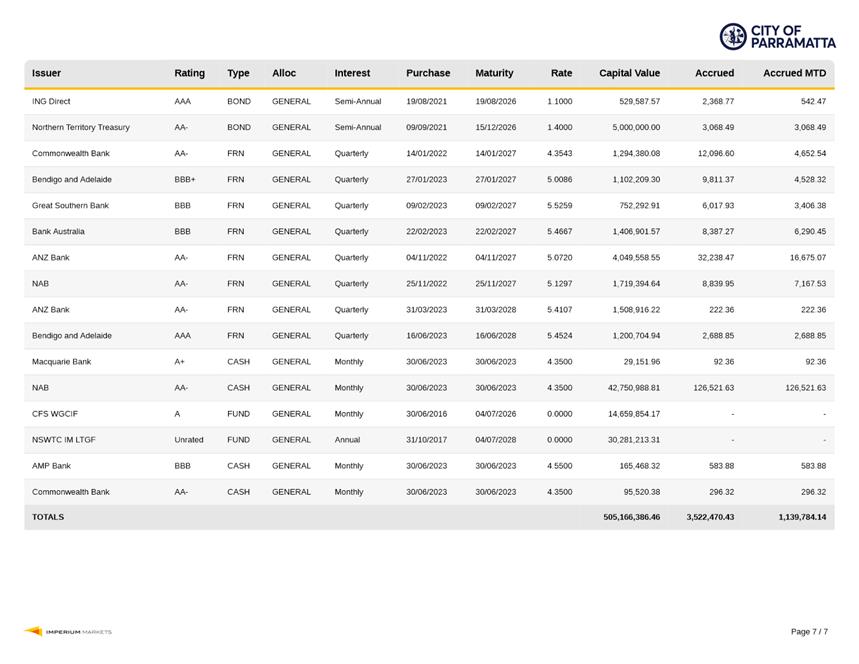

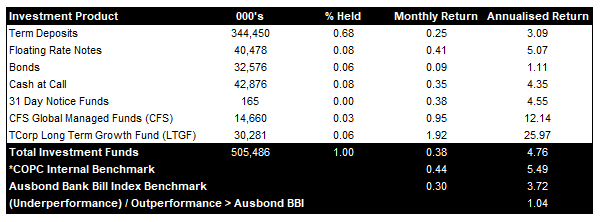

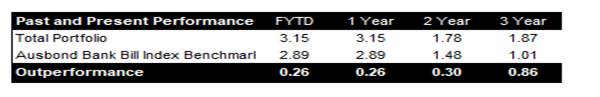

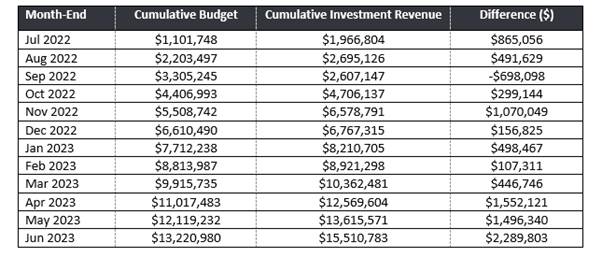

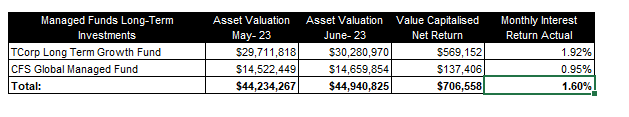

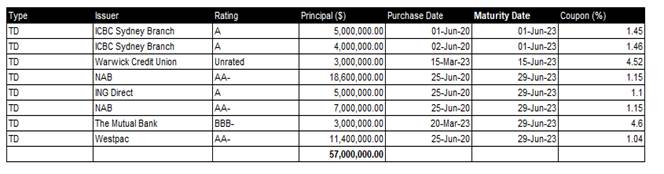

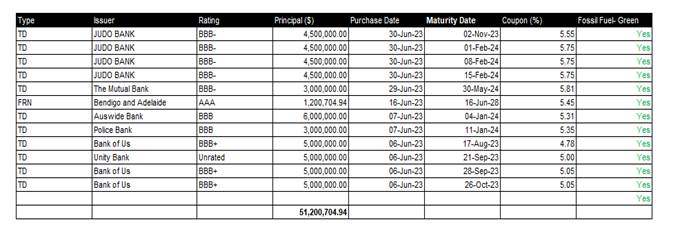

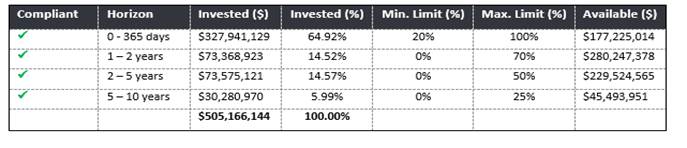

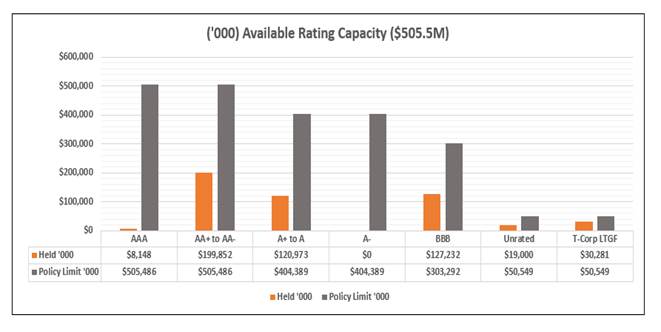

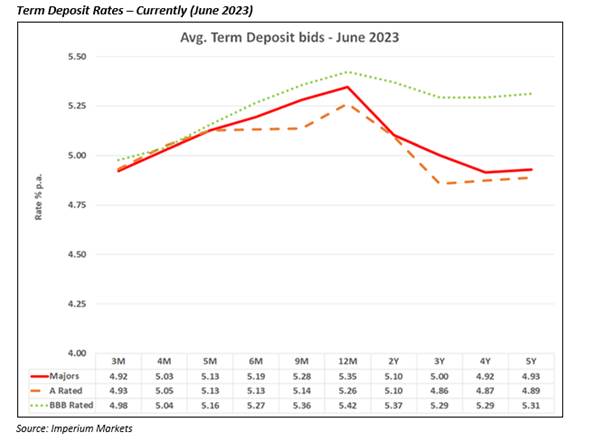

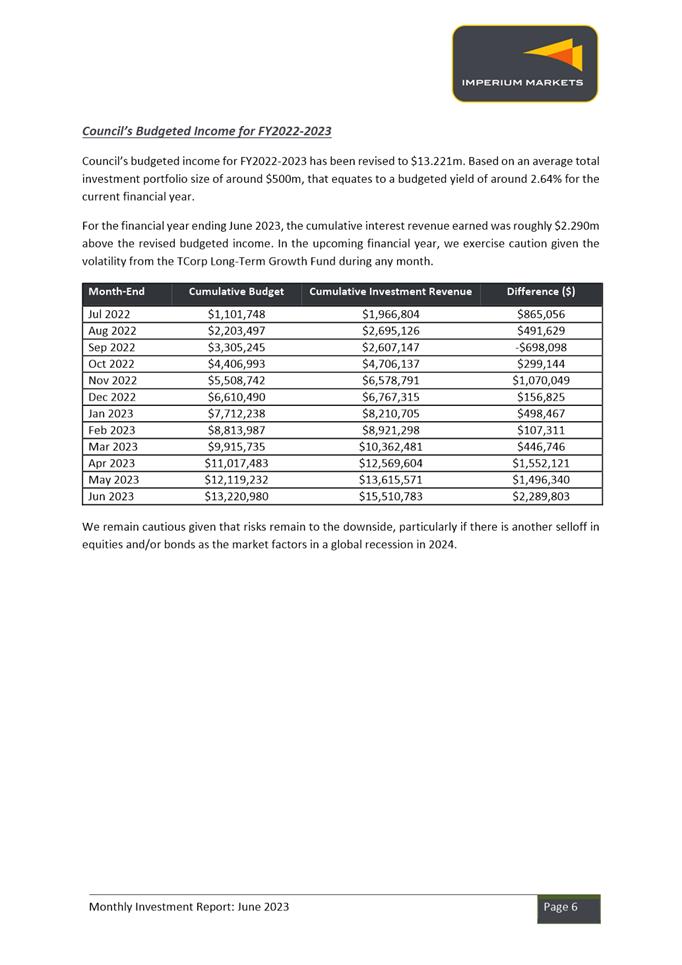

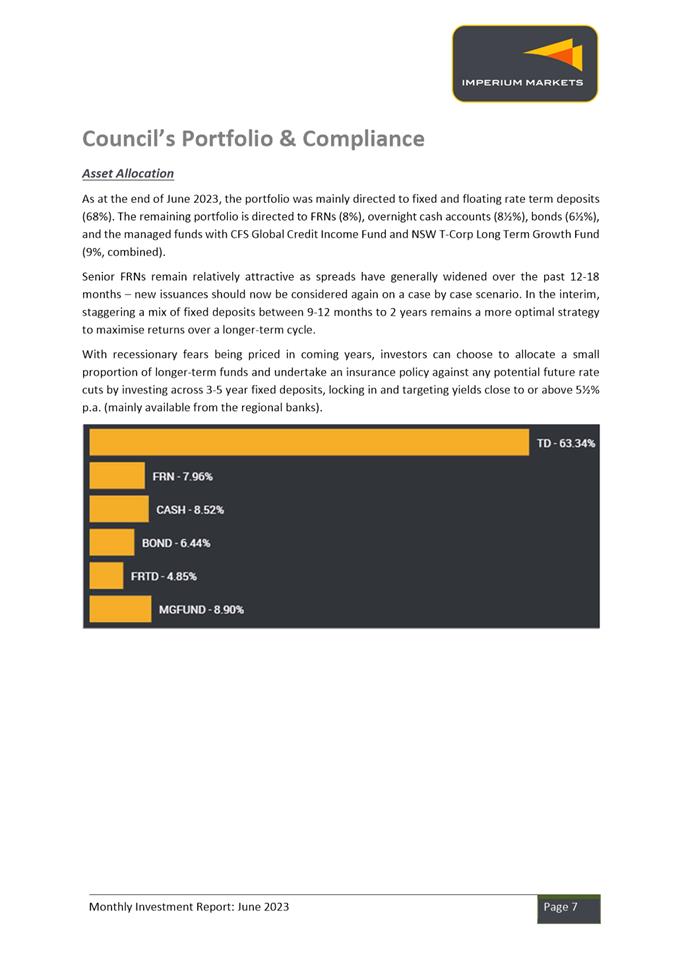

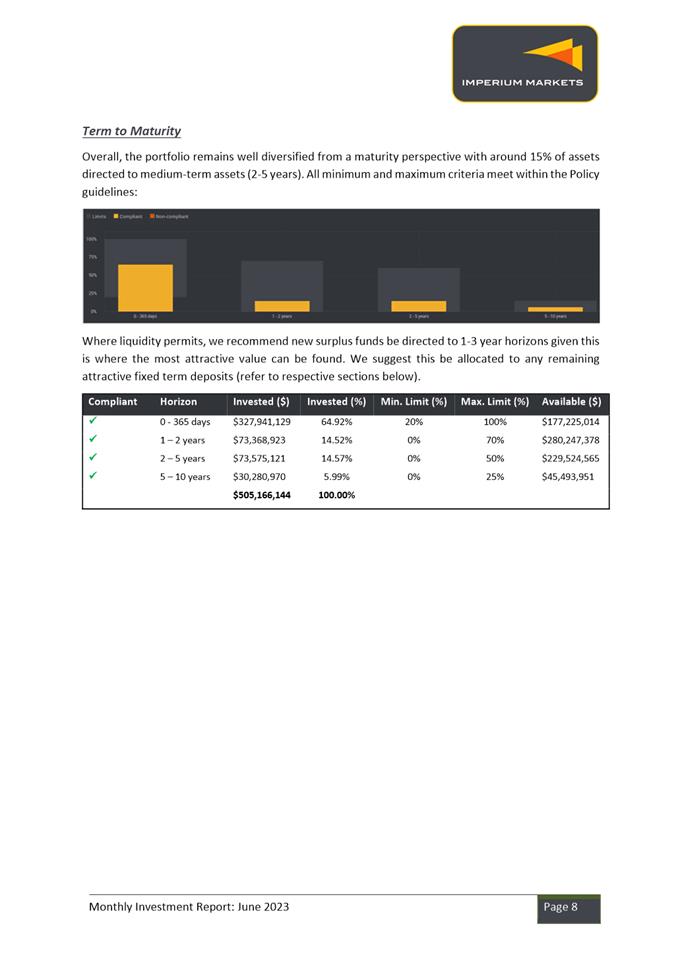

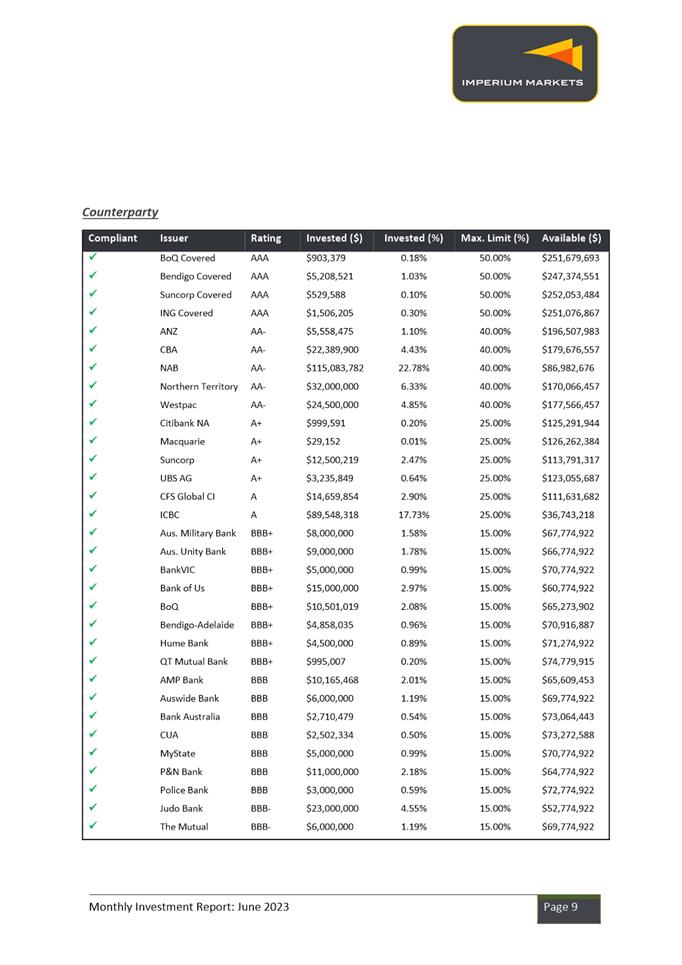

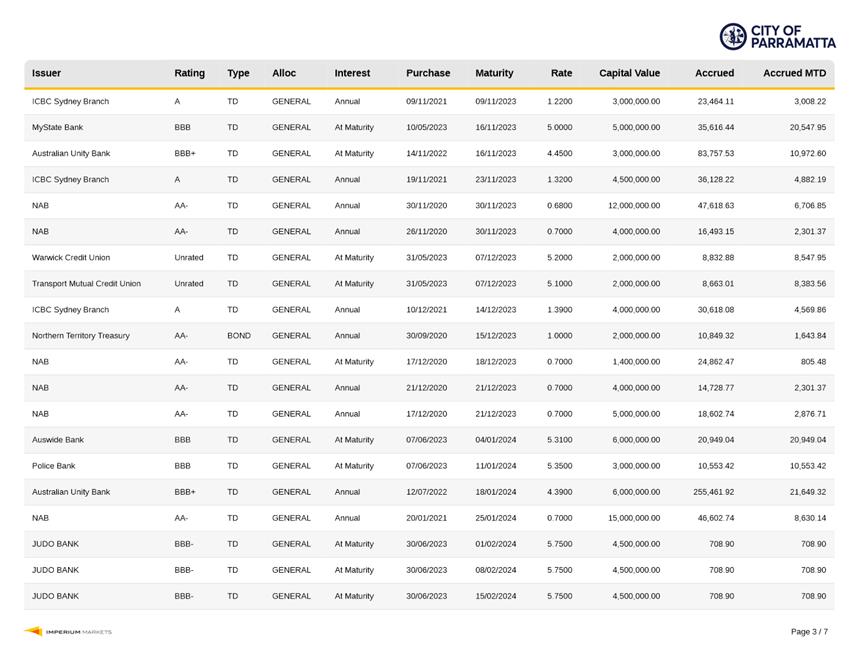

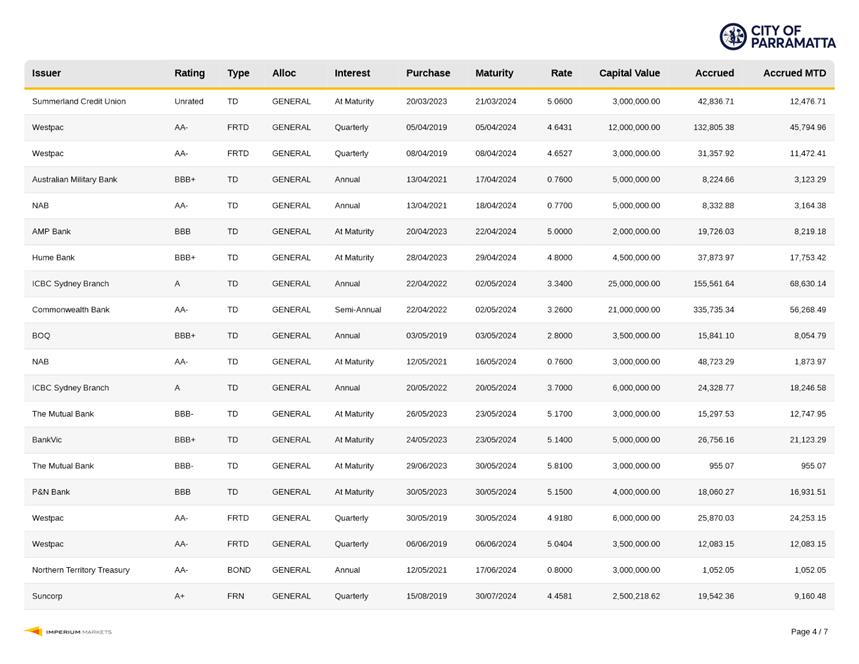

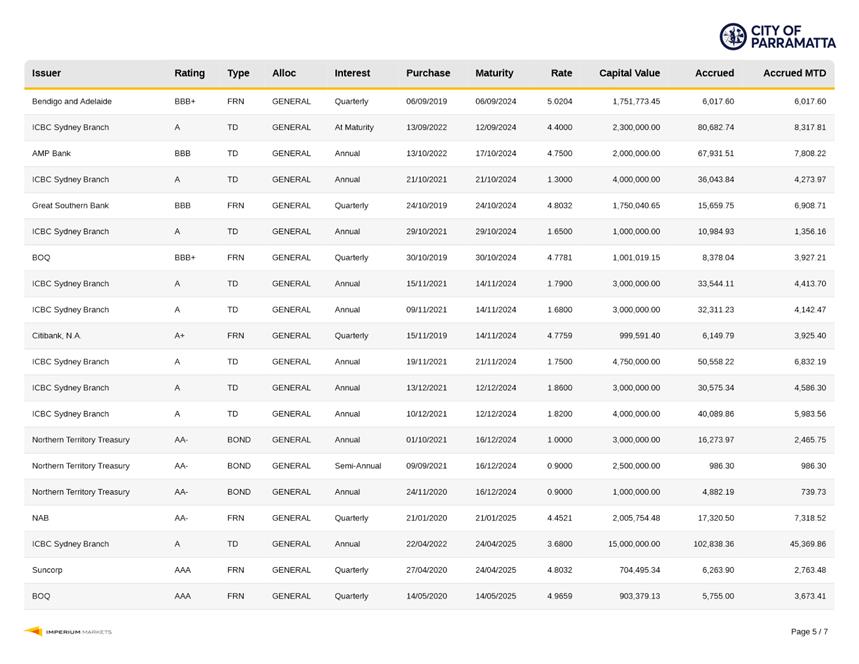

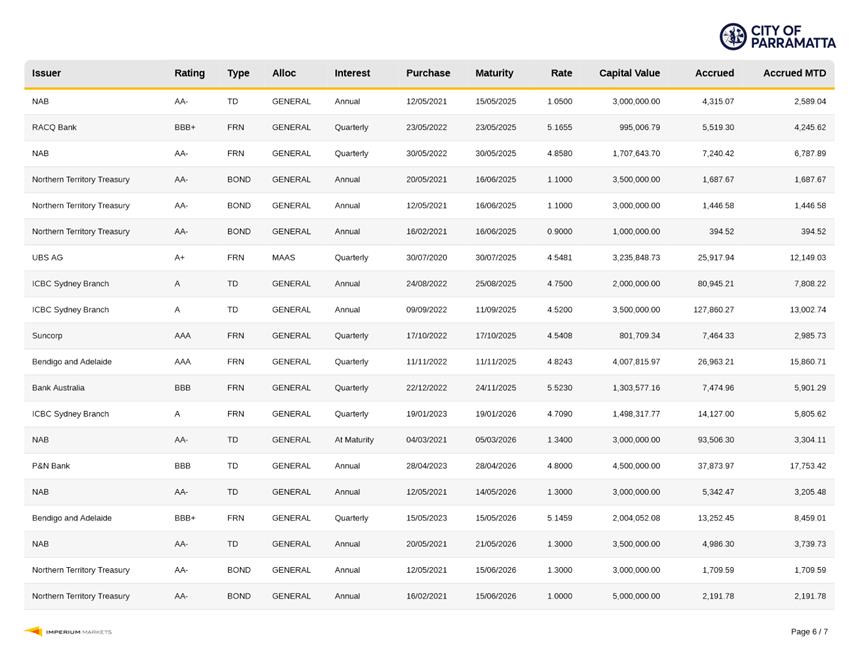

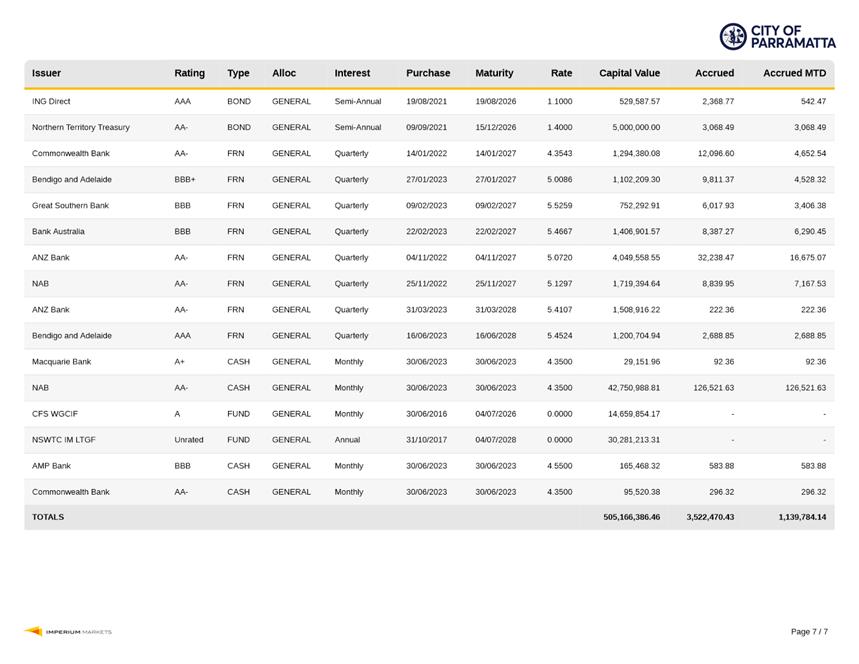

12.1 Investment

Report for June 2023......................................................... 60

13 Reports to Council -

For Council Decision

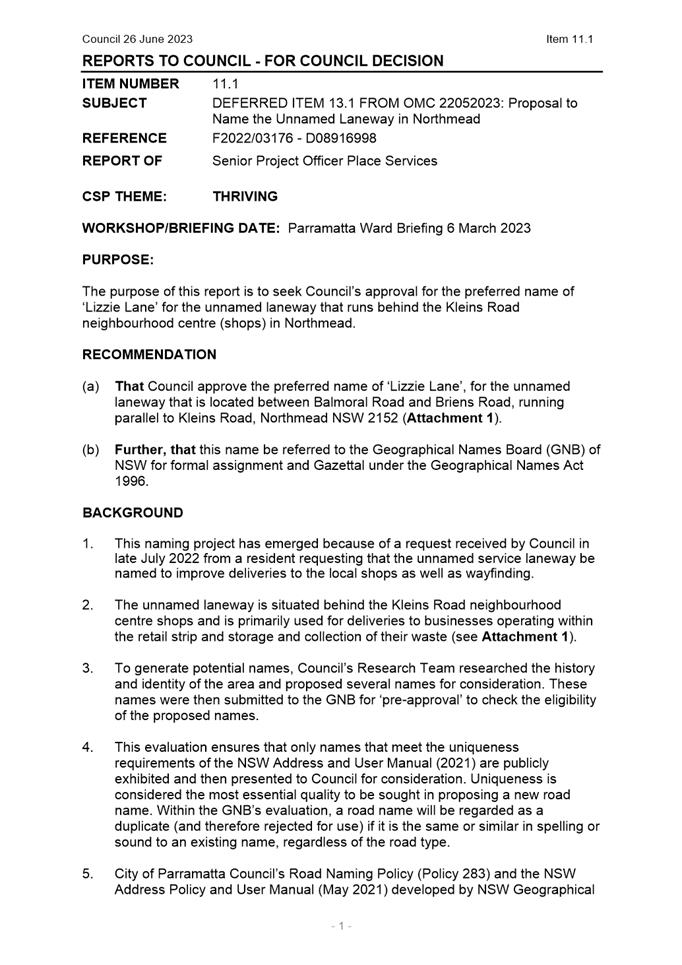

13.1 DEFERRED

from OMC 22 May 2023: Item 13.1: Proposal to Name the Unnamed Laneway in

Northmead..................................................... 112

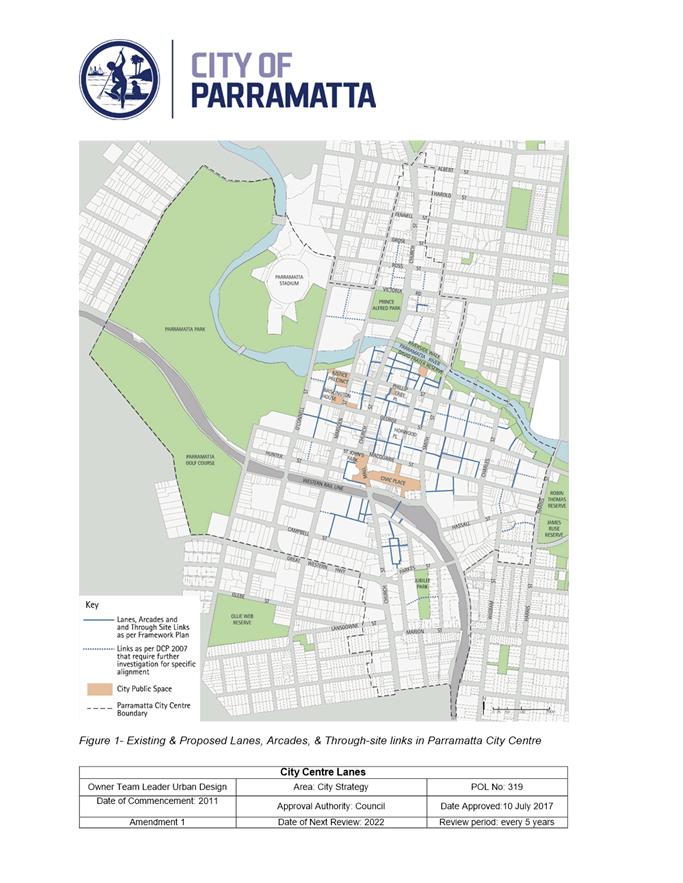

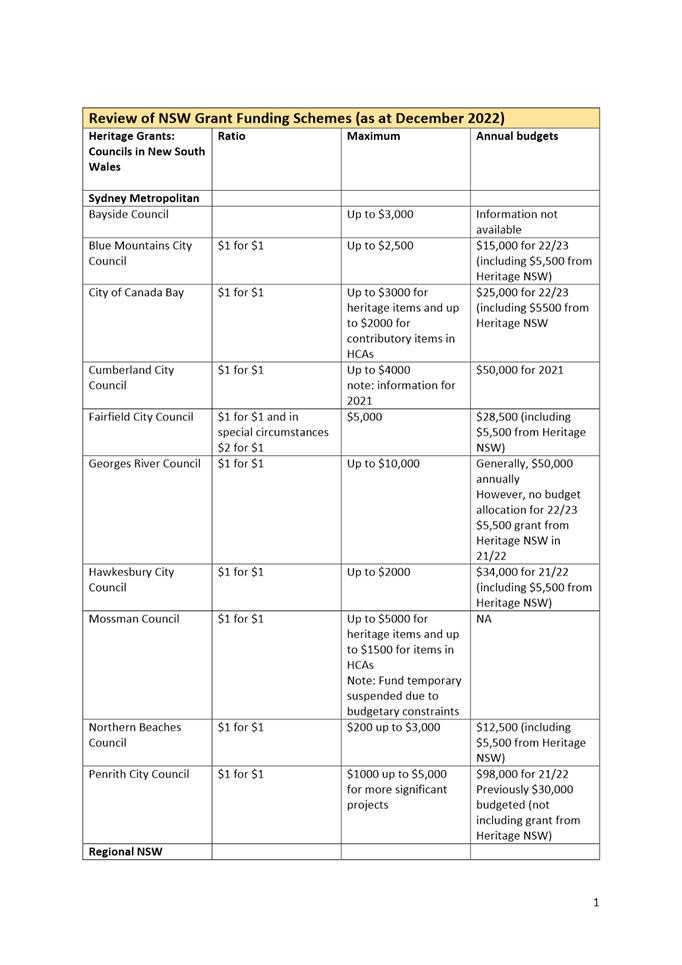

13.2 Policies

for Rescission: Keeping of Birds and Animals Policy, City Centre Lanes Policy.......................................................................................... 123

13.3 Appointment

of Community Members to the Active Transport Advisory Committee.............................................................................................. 144

13.4 Parramatta

Local Heritage Fund - Policy Review and Grant Allocations 148

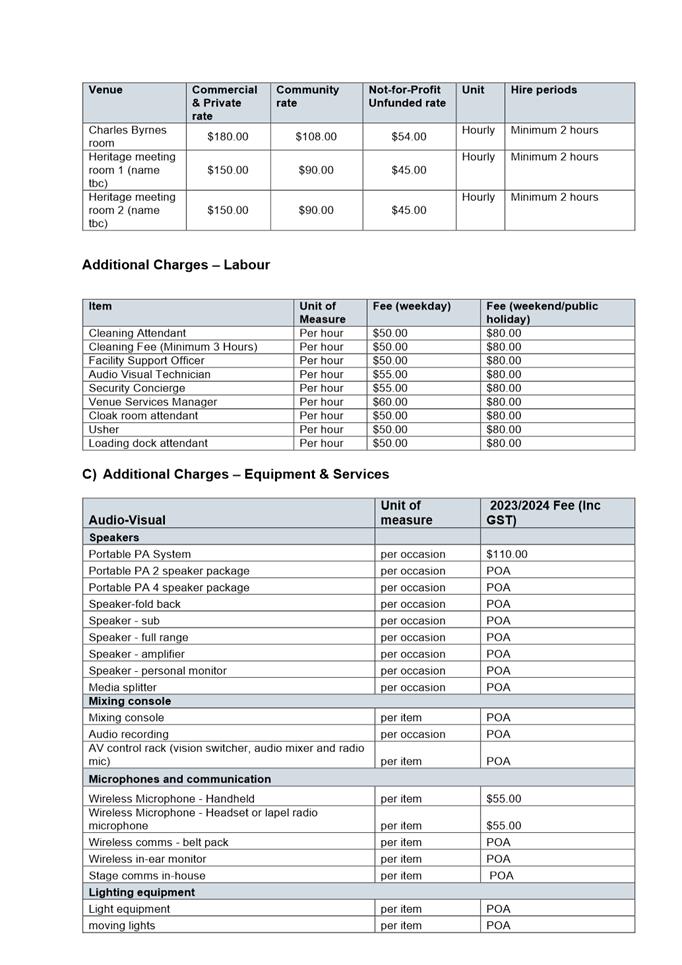

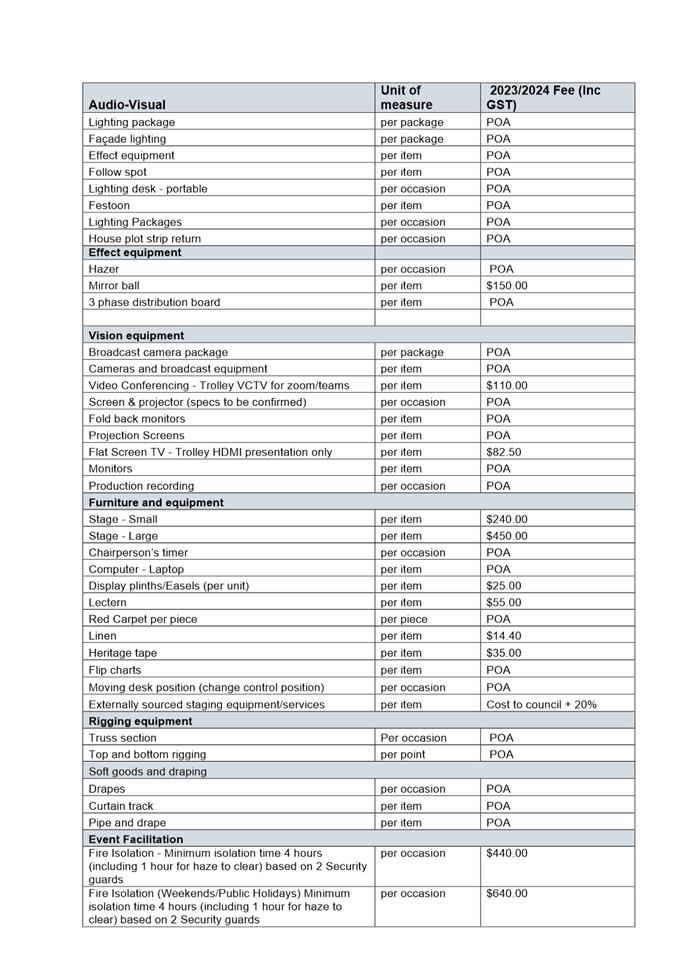

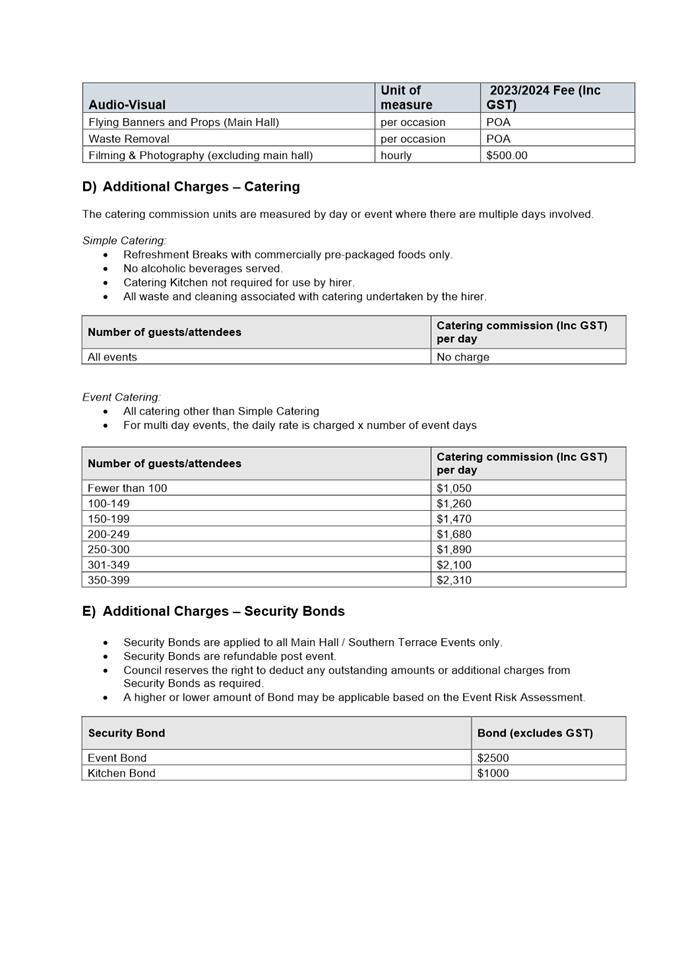

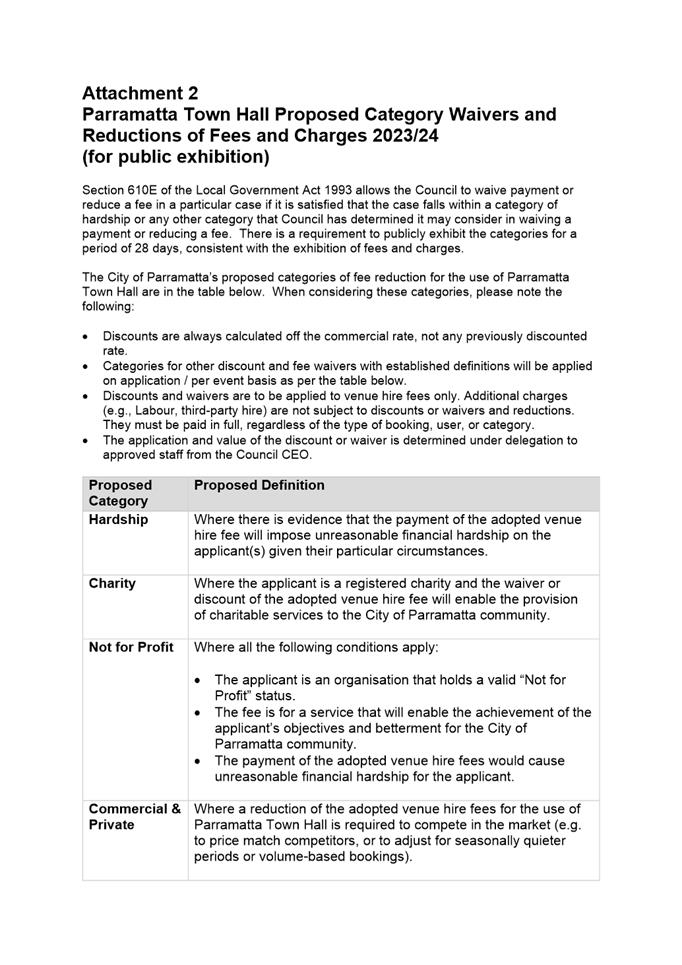

13.5 Parramatta

Town Hall - Draft Fees and Charges............................ 175

13.6 Proposed

Trial - Opening of PHIVE on Public Holidays................ 187

14 Notices of Motion

14.1 Proposed

Suburb Boundary Adjustment - Harris Park................... 192

14.2 Proposed

Review of Council's Circus Policy.................................... 195

14.3 Proposed

Safety Upgrade of Shared Pedestrian and Cyclist Path, Station Street East,

Harris Park....................................................................... 197

14.4 Sponsorships,

Corporate Memberships and Memoranda of Understanding 199

14.5 City

of Parramatta's Social Media Accounts.................................... 200

14.6 Revolving

Energy Fund....................................................................... 201

15 Questions with Notice

15.1 Question

Taken on Notice - 10 July 2023 Council Meeting.......... 204

15.2 Questions

With Notice - Council's Customer Service Charter and Service Standards............................................................................................... 206

16 Confidential Matters

16.1 ITT24/2022

- Collection and Receipt, Processing and Disposal of Residential and Commercial

Waste Services

This report is confidential in accordance with section

10A (2) (c) (d) of the Local Government Act 1993 as the report contains

information that would, if disclosed, confer a commercial advantage on a person

with whom the Council is conducting (or proposes to conduct) business; AND the

report contains commercial information of a confidential nature that would, if

disclosed (i) prejudice the commercial position of the person who supplied it;

or (ii) confer a commercial advantage on a competitor of the Council; or (iii)

reveal a trade secret.

16.2 Call

to Offer - 1-3x Brigg Road, Epping - Bert Park Memorial Hall

This report is confidential in accordance with section

10A (2) (c) (d) of the Local Government Act 1993 as the report contains

information that would, if disclosed, confer a commercial advantage on a person

with whom the Council is conducting (or proposes to conduct) business; AND the

report contains commercial information of a confidential nature that would, if

disclosed (i) prejudice the commercial position of the person who supplied it;

or (ii) confer a commercial advantage on a competitor of the Council; or (iii)

reveal a trade secret.

17 PUBLIC

ANNOUNCEMENT

18 CONCLUSION

OF MEETING

After the

conclusion of the Council Meeting, and if time permits, Councillors will be

provided an opportunity to ask questions of staff.

City of Parramatta Council – Minutes of Council Meeting – Monday,

10 July 2023

MINUTES

Council Meeting

Monday, 10 July 2023

6.30pm

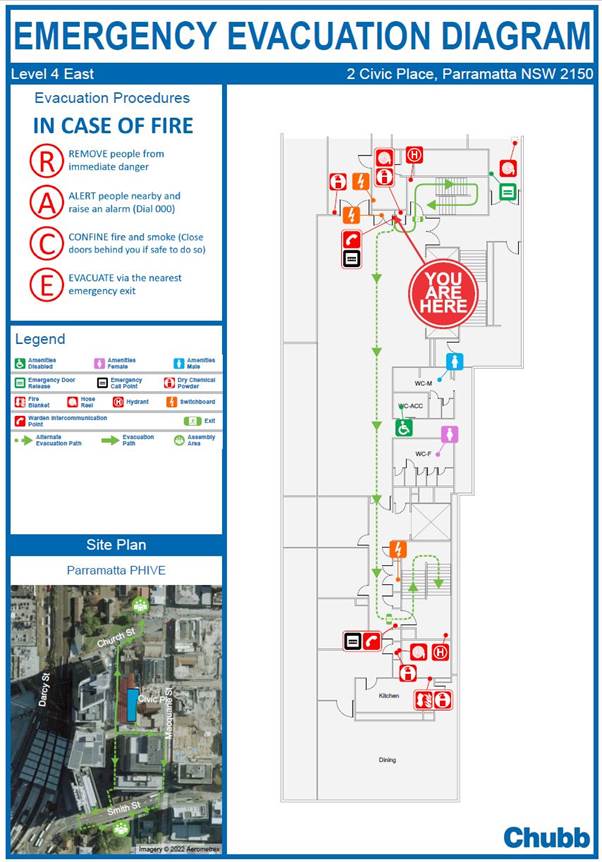

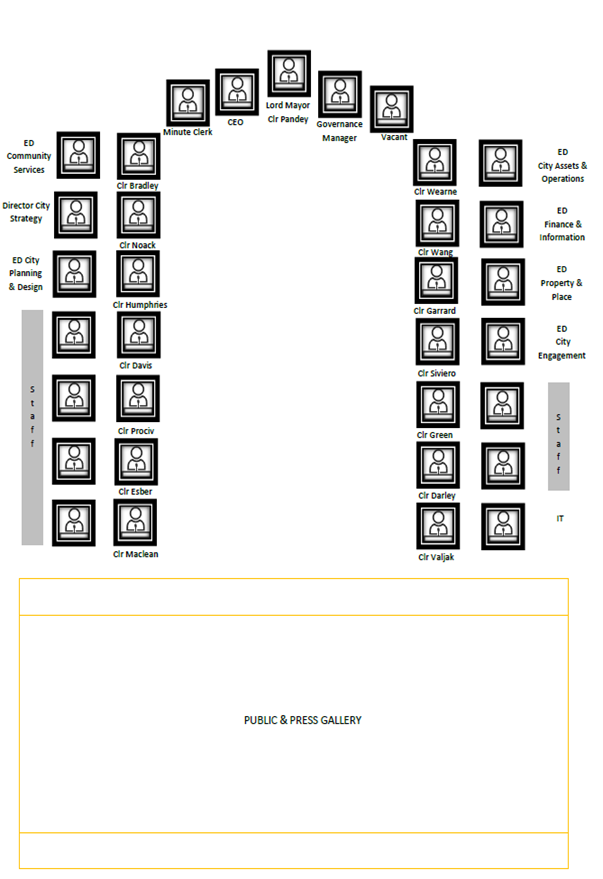

Council Chamber

Level 4, PHIVE

Parramatta Square, Parramatta

PRESENT

The Lord Mayor, Councillor Sameer Pandey and Councillors

Phil Bradley, Kellie Darley, Michelle Garrard, Henry Green, Ange Humphries, DLM

Cameron Maclean, Paul Noack, Dr Patricia Prociv, Dan Siviero, Georgina Valjak,

Donna Wang and Lorraine Wearne.

1. OPENING

MEETING

The Lord Mayor, Councillor Pandey, opened the meeting at 6:36PM.

2. ACKNOWLEDGEMENT

TO TRADITIONAL OWNERS OF LAND

The Lord Mayor acknowledged the Burramattagal people of The

Dharug Nation as the traditional owners of this land, and paid respect to their

ancient culture and to their elders past, present and emerging.

3. WEBCASTING

ANNOUNCEMENT

The Lord Mayor advised that this public meeting is being

recorded and streamed live on the internet. The recording will also be archived

and made available on Council’s website.

4. GENERAL

RECORDING OF MEETING ANNOUNCEMENT

As per Council’s Code of Meeting Practice, the

recording of the Council Meeting by the public using any device, audio or

video, is only permitted with Council permission.

5. APOLOGIES

AND APPLICATIONS FOR LEAVE OF ABSENCE OR ATTENDANCE BY AUDIO-VISUAL LINK BY

COUNCILLORS

|

|

Procedural

Motion

|

|

4383

|

RESOLVED Councillor Noack and Councillor

Wearne

(a)

That the request to attend the Ordinary Council

Meeting dated 10 July 2023 via remote means submitted by Councillor Valjak

due to personal reasons be accepted.

(b)

Further, that Councillor Esber and Councillor Davis be

granted a leave of absence for the Ordinary Council Meeting dated 10 July

2023.

|

6. CONFIRMATION

OF MINUTES

|

|

Minutes of

the Council Meeting held on 26 June 2023

|

|

4384

|

RESOLVED Councillor Noack and

Councillor Prociv

That the minutes be taken as read and be accepted as a true

record of the Meeting.

|

7. DISCLOSURES

OF INTEREST

Councillor Green declared a pecuniary interest in Item No

16.3 - Public Exhibition of Draft Parramatta River Flood Study

Report as he owns multiple properties that are in areas potentially

affected in the Flood Study Report. He left the meeting and did not vote on the

item.

The Lord Mayor Councillor Pandey declared a pecuniary

interest in Item No 16.3 - Public Exhibition of Draft

Parramatta River Flood Study Report as he owns a property that is in an

area potentially affected in the Flood Study Report. He left the meeting and

did not vote on the item.

8. Minutes of the Lord Mayor

|

8.1

|

The Voice Constitutional Referendum

(Report by The Lord Mayor

Councillor Sameer Pandey)

|

|

4385

|

RESOLVED The Lord Mayor Councillor Pandey

and Councillor Bradley

(a)

That Council

notes that the Prime Minister has committed to holding a referendum between

October-December 2023 to determine whether to alter The Constitution to recognise the First Peoples

of Australia by establishing an Aboriginal and Torres Strait Islander Voice.

(b)

That Council demonstrates and promotes open, respectful and constructive dialogue during

discussion of the referendum vote that upholds cultural safety and

acknowledges the diversity of views within the City of Parramatta community.

(c) That

Council acknowledges the lived experiences and voices of First Nations

people, particularly:

a. The

First Nations Advisory Committee, with whom Council has consulted, and is yet

to endorse a formal position on the proposed constitutional change;

b. Dharug

peoples; and

c. First

Nations people with connections to this country.

(d) That Council waive the hire fees for Council venues (to a

total budget waiver of $10,000) to facilitate open public discussion on the

proposed change in the lead up to the referendum and invite

applications from community representatives from all sides of the debate,

noting that applications must be for purposes consistent with this resolution

and operate in line with Council’s Facilities Hire Terms and

Conditions.

(e) That Council notes its existing agreement with Western Sydney

Community Forum to coordinate and deliver a

balanced program to the community of neutral information, local education and

awareness raising activities on the referendum.

(f) That consistent with Council’s previous resolution of 28 March 2022 to support Constitutional Recognition for Aboriginal and

Torres Strait Islander peoples and the key principles of the ‘Uluru

Statement from the Heart’, Council

support the proposed change to The Constitution as set out by The

Constitution Alteration (Aboriginal and Torres Strait Islander Voice) 2023,

passed on 19 June 2023.

(g)

Further that, all Councillors be advised of all facilities that are

hired by the Western Sydney Community Forum and any other public or community

group for the purposes of discussion regarding the proposed referendum

changes to the constitution.

Recording

of Voting:

For the

Motion: Councillors

Bradley, Darley, Humphries, Maclean, Noack, Pandey and Prociv

Against

the Motion: Councillors Garrard, Green, Siviero, Valjak, Wang and

Wearne

On being put to the Meeting,

voting on this Motion was seven votes FOR and six votes AGAINST. The Motion

was CARRIED.

|

|

8.2

|

Women's World Cup 2023

(Report by The Lord Mayor

Councillor Sameer Pandey)

|

|

4386

|

RESOLVED The Lord Mayor Councillor Pandey and

Councillor Garrard

(a)

That Council

celebrates the 2023 FIFA Women's

World Cup from 20 July-20 August 2023, highlighting that City of Parramatta

will host the grand final and several other matches at Accor Stadium.

(b) That Council notes that Parramatta Square will showcase livestreamed

matches and feature freestyler footballers, FIFA games stations, foosball

tables, Panna octagonal football cages and more, so fans can cheer on their team

with the global football community.

(c) Further,

that Council acknowledge the power of sport to bring people

together and increase visitors to the City of Parramatta, noting its

partnerships with Parramatta Square, Western Sydney Wanderers FC and Optus in

activating live sites and promotional opportunities.

|

|

|

Matter of Urgency – Condolence Motion for Mr

Warren Glenny

|

|

|

RESOLVED Councillor Humphries and

Councillor Noack

That Council consider a matter of urgency regarding the death

of Mr Warren Glenny, past President of Parramatta RSL and Castle Hill RSL.

The Lord Mayor ruled the matter

urgent.

|

|

4387

|

RESOLVED Councillor Humphries and

Councillor Noack

Councillor Humphries informed

Council of the sad passing of Mr Warren Glenny and extended her condolences

to Warren’s family.

That Council is to write a letter of Condolence to

Warren’s family.

|

|

Note:

|

The Chamber observed a minute silence.

|

9. Public Forum

Nil

10. Petitions

There were no petitions tabled at this meeting.

11. Rescission Motions

Nil

12. Reports to Council - For Notation

Nil

|

|

Procedural

Motion

|

|

4388

|

RESOLVED (Maclean/Noack)

That Items 13.2,13.3,

13.4,16.1 and 16.2 be resolved enbloc.

|

|

|

Note: Councillor Wearne voted against Item No 13.4.

|

13. Reports to Council - For Council Decision

|

13.1

|

2023/2024

Making of the Rates and Annual Charges

(Report of Rates & Receivables Manager)

|

|

|

Motion Councillor

Maclean and Councillor Prociv

(a)

That Council:

(i) Make

the Rates and Charges for the 2023/24 rating year as outlined in this report

using the land values with a base date valuation of 1 July 2022:

(ii) Make two

(2) ordinary rates, being Residential and Business;

(iii) Categorise

the Business rate into:

· Business

General

· Central

Business District

· Central

Business District – Centre of Activity No 2

· Industrial

Centres of Activity

(iv) Continue with

the minimum rate/ ad-valorem basis of rating

(b)

That Council

take up the Rate Peg increase of 3.7% for 2023/2024 as approved by IPART.

(c)

That Council

note that the City of Parramatta continues to recognise that certain

ratepayers in the community may have difficulty in meeting their Rates and

Charges commitments due to genuine hardship and prescribes policy and

procedures to provide financial assistance to these ratepayers.

(d) That Council:

(i) Make the ordinary

rates for all rateable land within the City of Parramatta, which is

categorised as Residential land (Residential), an ordinary rate-in-the-dollar

of zero point zero zero one zero four six six two (0.00104662) upon the land

value.

(ii) Note the minimum amount

of the Residential rate which shall be payable for the year in respect of any

individual parcel of this land categorized as Residential land (Residential)

is seven hundred and fifty-two dollars ($752.00).

(iii) Make the ordinary rates for

all rateable land within the City of Parramatta which is categorised as

Business General (Business General) land (and is not within the subcategories

of Business land referred to in paragraphs v to ix below), an ordinary

rate-in-the-dollar of zero point zero zero two seven nine two nine seven

(0.00279297) upon the land value.

(iv) Note the minimum amount of the

Business General rate which shall be payable for the year in respect of any

individual parcel of this land categorized as Business General land is five

hundred thirty-one dollars and forty-six cents ($531.46).

(v) Make the ordinary rates

for all rateable land within the City of Parramatta which is categorised as

business land and is within the sub-category of Central Business District

(CBD), an ordinary rate-in-the-dollar of zero point zero zero seven seven

three three four six (0.00773346) upon the land value.

(vi) Note the minimum amount of the

Business CBD rate which shall be payable for the year in respect of any

individual parcel of this land categorized as business land within the

sub-category of Central Business District (CBD) as seven hundred seventy

dollars and sixty-two cents ($770.62).

(vii) Make the ordinary rates for all

rateable land within the City of Parramatta which is categorised as Business

land and is within the sub-category of Central Business District –

Centre of Activity Area No 2 (CBD #2), an ordinary rate-in-the-dollar of zero

point zero one eight seven three nine six four (0.01873964) upon the land

value.

(viii) Make the ordinary rates for all rateable

land within the City of Parramatta which is categorised as Business land and

is within the sub-category of “Industrial Centres of Activity”

(Business ICA) because it is within the suburbs of Camellia, Chester Hill,

Clyde, Eastwood, Ermington, Granville, Guildford, Melrose Park, Merrylands, Northmead,

North Parramatta, Old Toongabbie, Parramatta, Pendle Hill, Rosehill,

Rydalmere, Seven Hills, Toongabbie, Wentworthville, Silverwater, North Rocks,

an ordinary rate-in-the-dollar of zero point zero zero three eight six nine

three two (0.00386932) upon the land value.

(ix) Note the minimum amount of the

rate which shall be payable for the year in respect of any individual parcel

of this land categorized as Business land within the sub-category of

“Industrial Centres of Activity” is seven hundred seventy dollars

and sixty-two cents ($770.62).

(e)

Domestic Waste Management Charges

That Council, in the case of all rateable land

within the City of Parramatta Council, for which a Domestic Waste Management

(DWM) service is provided or proposed to be provided in accordance with s496

of the Local Government Act 1993 set the following Domestic Waste

Management Charges:

(i) A Domestic Waste

Management Charge of four hundred fifty-seven dollars and eighty-five

cents ($457.85) for:

· Removal

once weekly of the contents of an 80-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional garden waste service.

(ii) A Domestic Waste Management

Charge of five hundred dollars and fifty-four cents ($500.54) for:

· Removal

once weekly of the contents of a 140-litre capacity garbage container

(including shared services), and to make a further pro-rata charge for each

additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional garden waste service.

(iii) A Domestic Waste Management Charge

of seven hundred fifty-four dollars and sixty-nine cents ($754.69) for:

· The

removal once weekly of the contents of a 240-litre capacity garbage container

(including shared services), and to make a further pro-rata charge for each

additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional fortnightly garden waste service.

(iv) A Domestic Waste Management Charge

of one thousand nine hundred dollars and seventy-one cents ($1900.71) for:

· The

removal once weekly of the contents of a 660-litre capacity garbage

container, and to make a further pro-rata charge for each additional service

requested.

(v) A Domestic Waste Management

Charge of two thousand six hundred five dollars and eighty-four cents

($2605.84) for:

· The

removal once weekly of the contents of an 1100-litre capacity garbage

container, and to make a further pro-rata charge for each additional service

requested.

(vi) A Domestic Waste Management

Availability Charge of eighty-nine dollars and eighty-eight cents ($89.88),

where a domestic waste service is available to vacant residential land and

where service is available but not used.

(f)

Commercial Garbage Charges:

That Council, in the case of all rateable land within the City of

Parramatta for which a Commercial Waste Management service is provided or

proposed to be provided, in accordance with s501 of the Local Government

Act 1993, set the following Commercial Garbage Charges:

(i) 140-litre

Commercial Garbage Charge of five hundred eighteen dollars and two cents

($518.02) for

· Removal

once weekly of the contents of a 140-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested.

(ii) 240-litre

Commercial Garbage Charge of seven hundred eighty dollars and forty-seven

($780.47) for

· Removal

once weekly of the contents of a 240-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested.

· The

removal once weekly 240-litre recycling bin for all recyclable material such

as paper, glass, PET plastics and the like, and to make a further pro rata

charge of one hundred thirty-seven dollars and thirty-four cents ($137.34)

for each additional weekly recycling service.

· The

removal once fortnightly of a 240-litre garden waste bin for all grass

clippings, pruning, leaves, woodchip and the like, and to make a further

pro-rata charge of one hundred thirty-seven dollars and thirty-four cents

($137.34) for each additional fortnightly garden waste service.

(iii) 660-litre

Commercial Garbage Charge of one thousand nine hundred fifty-four dollars and

thirty-seven cents ($1954.37) for

· Removal

once weekly of the contents of a 660-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested

(iv) 1100-litre

Commercial Garbage Charge of two thousand seven hundred forty-two dollars and

thirty-four cents ($2742.34) for

· Removal

once weekly of the contents of a 1100-litre capacity garbage container, and

to make a further pro-rata charge for each additional service requested.

(v) 660-litre

Commercial Recycling Charge of six hundred sixty-two dollars and sixty cents

($662.60) for

· Removal

once weekly of the contents of a 660-litre capacity recycling container, and

to make a further pro-rata charge for each additional service requested.

(vi) 1100-litre

Commercial Recycling Charge of eight hundred ninety-seven dollars and

fifty-four cents ($897.54) for

· Removal

once weekly of the contents of a 1100-litre capacity recycling container, and

to make a further pro-rata charge for each additional service requested.

(vii) 80-litre

Commercial Waste Charge four hundred sixty-six dollars and seventy-three

cents ($466.73) for:

· Removal

once weekly of the contents of an 80-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested:

(g)

Stormwater Management Services Charges

That Council make the following Stormwater Management Service Charges:

(i) In the case of all

parcels of rateable urban land (excluding strata properties and vacant land)

within the City of Parramatta which are categorised as Residential or

Residential CBD an annual charge of twenty-five dollars ($25.00) per

assessment.

(ii) In the case of all rateable

strata properties within the City of Parramatta which are categorised as

Residential or Residential CBD an annual charge of twelve dollars and fifty

cents ($12.50) per assessment.

(iii) In the case of all parcels of

rateable urban land within the City of Parramatta which are categorised or

sub-categorised as Business properties (excluding vacant land) an annual

charge of twenty-five dollars ($25.00) per 350 square metres or part thereof

capped at five hundred dollars ($500.00).

(iv) In the case of all rateable strata

properties within the City of Parramatta which are categorised as Business or

Business CBD an annual charge of twenty-five dollars ($25.00) per 350 square

metres or part thereof capped at five hundred dollars ($500.00). This charge

is then divided according to the unit entitlements of each lot, with a

minimum payable amount of five dollars ($5.00).

(h)

Further, that

Council adopt and charge the maximum rate of interest payable on overdue

rates and charges for the period 1 July 2023 to 30 June 2024 being 9.0% per

annum.

|

|

|

Foreshadowed Motion Councillor

Garrard and Councillor Wearne

(a) That Council:

(i) Make

the Rates and Charges for the 2023/24 rating year as per the year 2022/23

rates and use the land values with a base date valuation of 1 July 2022:

(ii) Make two

(2) ordinary rates, being Residential and Business;

(iii) Categorise

the Business rate into:

· Business

General

· Central

Business District

· Central

Business District – Centre of Activity No 2

· Industrial

Centres of Activity

(iv) Continue with

the minimum rate/ ad-valorem basis of rating

(b) That Council take up the Rate Peg

increase of 3.7% for 2023/2024 as approved by IPART and amend the financial

position accordingly including the requirement to go back to the public

exhibition.

(c) That Council note that the City of

Parramatta continues to recognise that certain ratepayers in the community

may have difficulty in meeting their Rates and Charges commitments due to

genuine hardship and prescribes policy and procedures to provide financial

assistance to these ratepayers.

(d) That Council:

(i) Make the ordinary

rates for all rateable land within the City of Parramatta, which is

categorised as Residential land (Residential), an ordinary rate-in-the-dollar

of zero point zero zero one zero four six six two (0.00104662) upon the land

value.

(ii) Note the minimum amount

of the Residential rate which shall be payable for the year in respect of any

individual parcel of this land categorized as Residential land (Residential)

is seven hundred and fifty-two dollars ($752.00).

(iii) Make the ordinary rates for

all rateable land within the City of Parramatta which is categorised as

Business General (Business General) land (and is not within the subcategories

of Business land referred to in paragraphs v to ix below), an ordinary

rate-in-the-dollar of zero point zero zero two seven nine two nine seven

(0.00279297) upon the land value.

(iv) Note the minimum amount of the

Business General rate which shall be payable for the year in respect of any

individual parcel of this land categorized as Business General land is five

hundred thirty-one dollars and forty-six cents ($531.46).

(v) Make the ordinary rates

for all rateable land within the City of Parramatta which is categorised as

business land and is within the sub-category of Central Business District

(CBD), an ordinary rate-in-the-dollar of zero point zero zero seven seven

three three four six (0.00773346) upon the land value.

(vi) Note the minimum amount of the

Business CBD rate which shall be payable for the year in respect of any

individual parcel of this land categorized as business land within the

sub-category of Central Business District (CBD) as seven hundred seventy

dollars and sixty-two cents ($770.62).

(vii) Make the ordinary rates for all

rateable land within the City of Parramatta which is categorised as Business

land and is within the sub-category of Central Business District –

Centre of Activity Area No 2 (CBD #2), an ordinary rate-in-the-dollar of zero

point zero one eight seven three nine six four (0.01873964) upon the land

value.

(viii) Make the ordinary rates for all rateable

land within the City of Parramatta which is categorised as Business land and

is within the sub-category of “Industrial Centres of Activity”

(Business ICA) because it is within the suburbs of Camellia, Chester Hill,

Clyde, Eastwood, Ermington, Granville, Guildford, Melrose Park, Merrylands, Northmead,

North Parramatta, Old Toongabbie, Parramatta, Pendle Hill, Rosehill,

Rydalmere, Seven Hills, Toongabbie, Wentworthville, Silverwater, North Rocks,

an ordinary rate-in-the-dollar of zero point zero zero three eight six nine

three two (0.00386932) upon the land value.

(ix) Note the minimum amount of the

rate which shall be payable for the year in respect of any individual parcel

of this land categorized as Business land within the sub-category of

“Industrial Centres of Activity” is seven hundred seventy dollars

and sixty-two cents ($770.62).

(e)

Domestic Waste Management Charges

That Council, in the case of all rateable land

within the City of Parramatta Council, for which a Domestic Waste Management

(DWM) service is provided or proposed to be provided in accordance with s496

of the Local Government Act 1993 set the following Domestic Waste

Management Charges:

(i) A Domestic Waste

Management Charge of four hundred fifty-seven dollars and eighty-five

cents ($457.85) for:

· Removal

once weekly of the contents of an 80-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional garden waste service.

(ii) A Domestic Waste Management

Charge of five hundred dollars and fifty-four cents ($500.54) for:

· Removal

once weekly of the contents of a 140-litre capacity garbage container

(including shared services), and to make a further pro-rata charge for each

additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional garden waste service.

(iii) A Domestic Waste Management Charge

of seven hundred fifty-four dollars and sixty-nine cents ($754.69) for:

· The

removal once weekly of the contents of a 240-litre capacity garbage container

(including shared services), and to make a further pro-rata charge for each

additional service requested; and

· The

removal once fortnightly of an additional 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro-rata charge of one hundred twenty-nine dollars and

ninety-nine cents ($129.99) for each additional fortnightly recycling

service.

· The

removal once fortnightly of an additional 240-litre garden waste bin for all

grass clippings, pruning, leaves, woodchip and the like, and to make a

further pro-rata charge of one hundred twenty-nine dollars and ninety-nine

cents ($129.99) for each additional fortnightly garden waste service.

(iv) A Domestic Waste Management Charge

of one thousand nine hundred dollars and seventy-one cents ($1900.71) for:

· The

removal once weekly of the contents of a 660-litre capacity garbage

container, and to make a further pro-rata charge for each additional service

requested.

(v) A Domestic Waste Management

Charge of two thousand six hundred five dollars and eighty-four cents

($2605.84) for:

· The

removal once weekly of the contents of an 1100-litre capacity garbage

container, and to make a further pro-rata charge for each additional service

requested.

(vi) A Domestic Waste Management

Availability Charge of eighty-nine dollars and eighty-eight cents ($89.88),

where a domestic waste service is available to vacant residential land and

where service is available but not used.

(f)

Commercial Garbage Charges:

That Council, in the case of all rateable land within the City of

Parramatta for which a Commercial Waste Management service is provided or

proposed to be provided, in accordance with s501 of the Local Government

Act 1993, set the following Commercial Garbage Charges:

(i) 140-litre

Commercial Garbage Charge of five hundred eighteen dollars and two cents

($518.02) for

· Removal

once weekly of the contents of a 140-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested.

(ii) 240-litre

Commercial Garbage Charge of seven hundred eighty dollars and forty-seven

($780.47) for

· Removal

once weekly of the contents of a 240-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested.

· The

removal once weekly 240-litre recycling bin for all recyclable material such

as paper, glass, PET plastics and the like, and to make a further pro rata

charge of one hundred thirty-seven dollars and thirty-four cents ($137.34)

for each additional weekly recycling service.

· The

removal once fortnightly of a 240-litre garden waste bin for all grass

clippings, pruning, leaves, woodchip and the like, and to make a further

pro-rata charge of one hundred thirty-seven dollars and thirty-four cents

($137.34) for each additional fortnightly garden waste service.

(iii) 660-litre

Commercial Garbage Charge of one thousand nine hundred fifty-four dollars and

thirty-seven cents ($1954.37) for

· Removal

once weekly of the contents of a 660-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested

(iv) 1100-litre

Commercial Garbage Charge of two thousand seven hundred forty-two dollars and

thirty-four cents ($2742.34) for

· Removal

once weekly of the contents of a 1100-litre capacity garbage container, and

to make a further pro-rata charge for each additional service requested.

(v) 660-litre

Commercial Recycling Charge of six hundred sixty-two dollars and sixty cents

($662.60) for

· Removal

once weekly of the contents of a 660-litre capacity recycling container, and

to make a further pro-rata charge for each additional service requested.

(vi) 1100-litre

Commercial Recycling Charge of eight hundred ninety-seven dollars and

fifty-four cents ($897.54) for

· Removal

once weekly of the contents of a 1100-litre capacity recycling container, and

to make a further pro-rata charge for each additional service requested.

(vii) 80-litre

Commercial Waste Charge four hundred sixty-six dollars and seventy-three

cents ($466.73) for:

· Removal

once weekly of the contents of an 80-litre capacity garbage container, and to

make a further pro-rata charge for each additional service requested:

(g)

Stormwater Management Services Charges

That Council make the following Stormwater Management Service Charges:

(i) In the case of all

parcels of rateable urban land (excluding strata properties and vacant land)

within the City of Parramatta which are categorised as Residential or

Residential CBD an annual charge of twenty-five dollars ($25.00) per

assessment.

(ii) In the case of all rateable

strata properties within the City of Parramatta which are categorised as

Residential or Residential CBD an annual charge of twelve dollars and fifty

cents ($12.50) per assessment.

(iii) In the case of all parcels of

rateable urban land within the City of Parramatta which are categorised or

sub-categorised as Business properties (excluding vacant land) an annual

charge of twenty-five dollars ($25.00) per 350 square metres or part thereof

capped at five hundred dollars ($500.00).

(iv) In the case of all rateable strata

properties within the City of Parramatta which are categorised as Business or

Business CBD an annual charge of twenty-five dollars ($25.00) per 350 square

metres or part thereof capped at five hundred dollars ($500.00). This charge

is then divided according to the unit entitlements of each lot, with a

minimum payable amount of five dollars ($5.00).

(h)

Further, that

Council adopt and charge the maximum rate of interest payable on overdue

rates and charges for the period 1 July 2023 to 30 June 2024 being 9.0% per

annum.

|

|

4389

|

RESOLVED Councillor Maclean and Councillor Prociv

(a) That Council:

(i) Make

the Rates and Charges for the 2023/24 rating year as outlined in this report

using the land values with a base date valuation of 1 July 2022:

(ii) Make

two (2) ordinary rates, being Residential and Business;

(iii) Categorise

the Business rate into:

· Business

General

· Central

Business District

· Central

Business District – Centre of Activity No 2

· Industrial

Centres of Activity

(iv) Continue

with the minimum rate/ ad-valorem basis of rating

(b) That Council take up the Rate Peg increase of 3.7% for

2023/2024 as approved by IPART.

(c) That Council note that the City of Parramatta continues to

recognise that certain ratepayers in the community may have difficulty in

meeting their Rates and Charges commitments due to genuine hardship and

prescribes policy and procedures to provide financial assistance to these

ratepayers.

(d)

That Council:

(i) Make

the ordinary rates for all rateable land within the City of Parramatta, which

is categorised as Residential land (Residential), an ordinary

rate-in-the-dollar of zero point zero zero one zero four six six two

(0.00104662) upon the land value.

(ii) Note

the minimum amount of the Residential rate which shall be payable for the

year in respect of any individual parcel of this land categorized as

Residential land (Residential) is seven hundred and fifty-two dollars

($752.00).

(iii) Make

the ordinary rates for all rateable land within the City of Parramatta which

is categorised as Business General (Business General) land (and is not within

the subcategories of Business land referred to in paragraphs v to ix below),

an ordinary rate-in-the-dollar of zero point zero zero two seven nine two

nine seven (0.00279297) upon the land value.

(iv) Note

the minimum amount of the Business General rate which shall be payable for

the year in respect of any individual parcel of this land categorized as

Business General land is five hundred thirty-one dollars and forty-six cents

($531.46).

(v) Make

the ordinary rates for all rateable land within the City of Parramatta which

is categorised as business land and is within the sub-category of Central

Business District (CBD), an ordinary rate-in-the-dollar of zero point zero

zero seven seven three three four six (0.00773346) upon the land value.

(vi) Note

the minimum amount of the Business CBD rate which shall be payable for the

year in respect of any individual parcel of this land categorized as business

land within the sub-category of Central Business District (CBD) as seven

hundred seventy dollars and sixty-two cents ($770.62).

(vii) Make the

ordinary rates for all rateable land within the City of Parramatta which is

categorised as Business land and is within the sub-category of Central

Business District – Centre of Activity Area No 2 (CBD #2), an ordinary

rate-in-the-dollar of zero point zero one eight seven three nine six four

(0.01873964) upon the land value.

(viii) Make the

ordinary rates for all rateable land within the City of Parramatta which is

categorised as Business land and is within the sub-category of

“Industrial Centres of Activity” (Business ICA) because it is

within the suburbs of Camellia, Chester Hill, Clyde, Eastwood, Ermington,

Granville, Guildford, Melrose Park, Merrylands, Northmead, North Parramatta,

Old Toongabbie, Parramatta, Pendle Hill, Rosehill, Rydalmere, Seven Hills,

Toongabbie, Wentworthville, Silverwater, North Rocks, an ordinary

rate-in-the-dollar of zero point zero zero three eight six nine three two

(0.00386932) upon the land value.

(ix) Note

the minimum amount of the rate which shall be payable for the year in respect

of any individual parcel of this land categorized as Business land within the

sub-category of “Industrial Centres of Activity” is seven hundred

seventy dollars and sixty-two cents ($770.62).

(e)

Domestic Waste Management

Charges

That Council, in the case of

all rateable land within the City of Parramatta Council, for which a Domestic

Waste Management (DWM) service is provided or proposed to be provided in

accordance with s496 of the Local Government Act 1993 set the

following Domestic Waste Management Charges:

(i) A

Domestic Waste Management Charge of four

hundred fifty-seven dollars and eighty-five cents ($457.85) for:

· Removal once weekly of the contents of an 80-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested; and

· The removal once fortnightly of an additional 240-litre

recycling bin for all recyclable material such as paper, glass, PET plastics

and the like, and to make a further pro-rata charge of one hundred

twenty-nine dollars and ninety-nine cents ($129.99) for each additional

fortnightly recycling service.

· The removal once fortnightly of an additional 240-litre

garden waste bin for all grass clippings, pruning, leaves, woodchip and the

like, and to make a further pro-rata charge of one hundred twenty-nine

dollars and ninety-nine cents ($129.99) for each additional garden waste

service.

(ii) A Domestic Waste Management Charge of five hundred

dollars and fifty-four cents ($500.54) for:

· Removal once weekly of the contents of a 140-litre

capacity garbage container (including shared services), and to make a further

pro-rata charge for each additional service requested; and

· The removal once fortnightly of an additional 240-litre

recycling bin for all recyclable material such as paper, glass, PET plastics

and the like, and to make a further pro-rata charge of one hundred

twenty-nine dollars and ninety-nine cents ($129.99) for each additional

fortnightly recycling service.

· The removal once fortnightly of an additional 240-litre

garden waste bin for all grass clippings, pruning, leaves, woodchip and the

like, and to make a further pro-rata charge of one hundred twenty-nine

dollars and ninety-nine cents ($129.99) for each additional garden waste

service.

(iii) A Domestic Waste Management Charge of seven hundred

fifty-four dollars and sixty-nine cents ($754.69) for:

· The removal once weekly of the contents of a 240-litre

capacity garbage container (including shared services), and to make a further

pro-rata charge for each additional service requested; and

· The removal once fortnightly of an additional 240-litre

recycling bin for all recyclable material such as paper, glass, PET plastics

and the like, and to make a further pro-rata charge of one hundred

twenty-nine dollars and ninety-nine cents ($129.99) for each additional

fortnightly recycling service.

· The removal once fortnightly of an additional 240-litre

garden waste bin for all grass clippings, pruning, leaves, woodchip and the

like, and to make a further pro-rata charge of one hundred twenty-nine

dollars and ninety-nine cents ($129.99) for each additional fortnightly

garden waste service.

(iv) A Domestic Waste Management Charge of one thousand nine

hundred dollars and seventy-one cents ($1900.71) for:

· The removal once weekly of the contents of a 660-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested.

(v) A Domestic Waste Management Charge of two thousand six

hundred five dollars and eighty-four cents ($2605.84) for:

· The removal once weekly of the contents of an 1100-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested.

(vi) A Domestic Waste Management Availability Charge of

eighty-nine dollars and eighty-eight cents ($89.88), where a domestic waste

service is available to vacant residential land and where service is

available but not used.

(f)

Commercial Garbage

Charges:

That Council, in the case of all rateable land within the City of

Parramatta for which a Commercial Waste Management service is provided or

proposed to be provided, in accordance with s501 of the Local Government

Act 1993, set the following Commercial Garbage Charges:

(i) 140-litre Commercial Garbage Charge of five hundred

eighteen dollars and two cents ($518.02) for

· Removal once weekly of the contents of a 140-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested.

(ii) 240-litre Commercial Garbage Charge of seven hundred

eighty dollars and forty-seven ($780.47) for

· Removal once weekly of the contents of a 240-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested.

· The removal once weekly 240-litre recycling bin for all

recyclable material such as paper, glass, PET plastics and the like, and to

make a further pro rata charge of one hundred thirty-seven dollars and

thirty-four cents ($137.34) for each additional weekly recycling service.

· The removal once fortnightly of a 240-litre garden waste

bin for all grass clippings, pruning, leaves, woodchip and the like, and to

make a further pro-rata charge of one hundred thirty-seven dollars and

thirty-four cents ($137.34) for each additional fortnightly garden waste

service.

(iii) 660-litre Commercial Garbage Charge of one thousand nine

hundred fifty-four dollars and thirty-seven cents ($1954.37) for

· Removal once weekly of the contents of a 660-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested

(iv) 1100-litre Commercial Garbage Charge of two thousand

seven hundred forty-two dollars and thirty-four cents ($2742.34) for

· Removal once weekly of the contents of a 1100-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested.

(v) 660-litre Commercial Recycling Charge of six hundred

sixty-two dollars and sixty cents ($662.60) for

· Removal once weekly of the contents of a 660-litre

capacity recycling container, and to make a further pro-rata charge for each

additional service requested.

(vi) 1100-litre Commercial Recycling Charge of eight hundred

ninety-seven dollars and fifty-four cents ($897.54) for

· Removal once weekly of the contents of a 1100-litre

capacity recycling container, and to make a further pro-rata charge for each

additional service requested.

(vii) 80-litre Commercial Waste Charge four hundred sixty-six

dollars and seventy-three cents ($466.73) for:

· Removal once weekly of the contents of an 80-litre

capacity garbage container, and to make a further pro-rata charge for each

additional service requested:

(g)

Stormwater Management

Services Charges

That Council make the following Stormwater Management Service Charges:

(i) In

the case of all parcels of rateable urban land (excluding strata properties

and vacant land) within the City of Parramatta which are categorised as

Residential or Residential CBD an annual charge of twenty-five dollars

($25.00) per assessment.

(ii) In

the case of all rateable strata properties within the City of Parramatta

which are categorised as Residential or Residential CBD an annual charge of

twelve dollars and fifty cents ($12.50) per assessment.

(iii) In the

case of all parcels of rateable urban land within the City of Parramatta

which are categorised or sub-categorised as Business properties (excluding

vacant land) an annual charge of twenty-five dollars ($25.00) per 350 square

metres or part thereof capped at five hundred dollars ($500.00).

(iv) In the

case of all rateable strata properties within the City of Parramatta which

are categorised as Business or Business CBD an annual charge of twenty-five

dollars ($25.00) per 350 square metres or part thereof capped at five hundred

dollars ($500.00). This charge is then divided according to the unit

entitlements of each lot, with a minimum payable amount of five dollars

($5.00).

(h) Further, that Council adopt and charge the maximum rate of interest

payable on overdue rates and charges for the period 1 July 2023 to 30 June

2024 being 9.0% per annum.

|

|

13.2

|

Public Exhibition of Draft Procurement Policy

(Report of Policy Officer)

|

|

4390

|

RESOLVED Councillor Maclean and

Councillor Noack

(a) That the draft Procurement Policy be placed on public

exhibition for a period of 28 days.

(b)

That

Council authorises the Chief

Executive Officer to make any necessary editorial and content changes to the draft

Procurement Policy for public exhibition to give effect to Council’s

resolution.

(c)

Further, that staff

prepare a report to Council following the exhibition period to present a

final draft Procurement Policy for adoption.

|

|

13.3

|

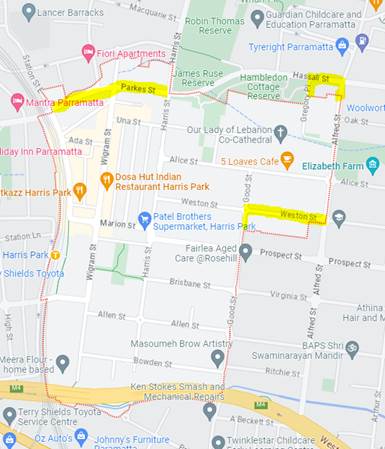

Public Exhibition of Alcohol Free Zones within the City of

Parramatta LGA

(Report of City

Safe Operations Manager)

|

|

4391

|

RESOLVED Councillor Maclean and

Councillor Noack

(a) That

Council endorse and establish the Alcohol Free Zones set out in Attachment

1 to operate for 4 years, commencing 7 days after the public notification

of the Alcohol Free Zones.

(b) Further, that Council authorise the Chief Executive Officer to

temporarily suspend the operation of any of the established Alcohol Free

Zones throughout the local government area for the purpose of events.

|

|

13.4

|

Public Exhibition of Draft Parramatta Bike Plan 2023

(Report of Senior Project Officer

Transport Planning)

|

|

4392

|

RESOLVED Councillor Maclean and

Councillor Noack

(a) That Council endorses for the purposes of public exhibition

the draft Parramatta Bike Plan 2023 at Attachment 1 for a period of

not less than 28 days.

(b) That Council delegate authority to the Chief Executive

Officer to make formatting and minor editorial adjustments to the draft Parramatta Bike Plan 2023.

(c)

Further, that the results of the public exhibition of the draft

Parramatta Bike Plan 2023 be reported back to Council for its consideration.

|

|

13.5

|

Adoption of Councillor and Staff Interaction Policy 2023

(Report of Policy Officer)

|

|

4393

|

RESOLVED Councillor Humphries and

Councillor Prociv)

That this matter be

deferred and referred to the Policy Review Committee.

|

|

13.6

|

Endorsement of City Events and Festival FY24 Program

(Report of Manager City Events

and Festivals)

|

|

4394

|

RESOLVED Councillor Prociv and Councillor Humphries

(a) That Council endorse the City Events and Festival Plan for the 2023-2024 financial

year.

(b) That Council note:

i. the program aligns to the endorsed

2020-2025 City of Parramatta Events and Festivals Strategy;

ii. the program reflects the feedback received

throughout Councillor workshops and consultation;

iii. the programs to be delivered as

‘partnerships’ are dependent on third party agreements and may be

subject to change; and

iv. the individual operational budgets for each

event may be adjusted throughout the year depending on market factors,

however the program in its entirety will not exceed the 2023/24 events and

festivals scope or operating budget.

(c)

Further, that any additional events/programs that are

proposed to be included in the program will require Council to resolve to

provide additional budget funds and resourcing (staffing) prior to inclusion

in the 2023/24 program.

|

|

Note:

|

Questions were taken on notice for this item.

|

|

|

Procedural

Motion

|

|

|

RESOLVED Councillor Maclean and Councillor

Garrard

That the meeting be adjourned, the time being 8.25pm.

|

|

|

Note: At the time the meeting was reconvened, the

following Councillors were present: The Lord Mayor, Councillor Pandey and

Councillors Bradley, Darley, Garrard, Green, Maclean, Noack, Dr Prociv,

Siviero, Valjak, Wang and Wearne.

|

|

Note:

|

Council reconvened at 8:35pm.

|

|

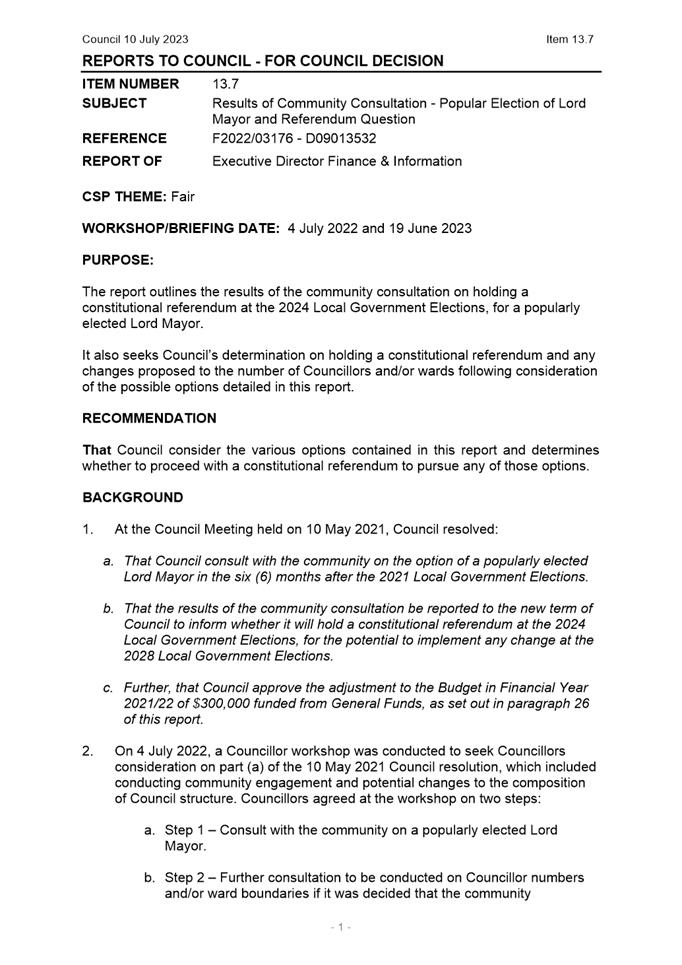

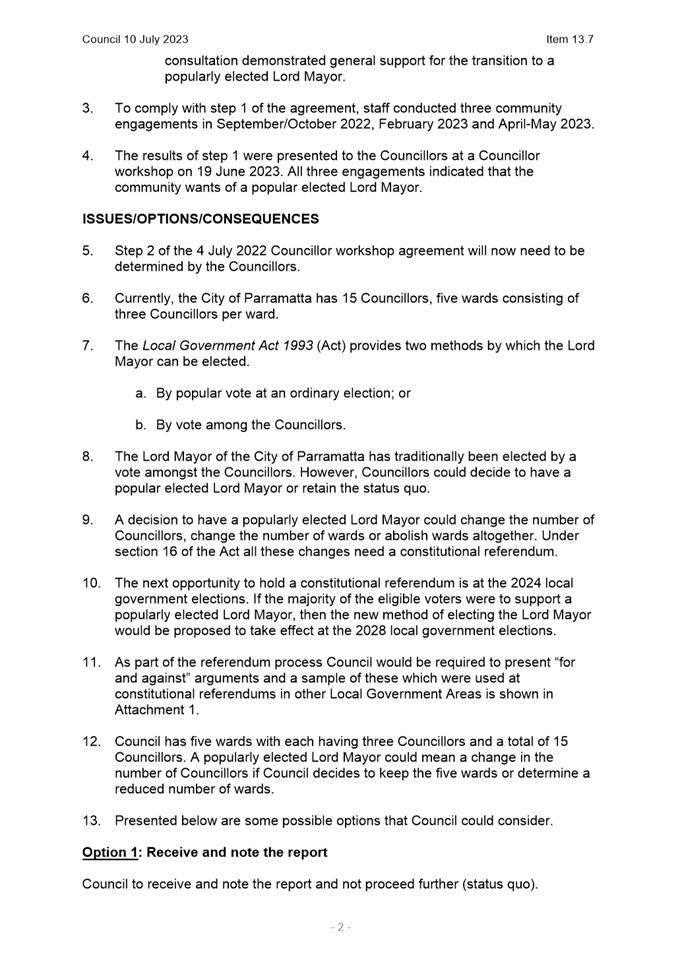

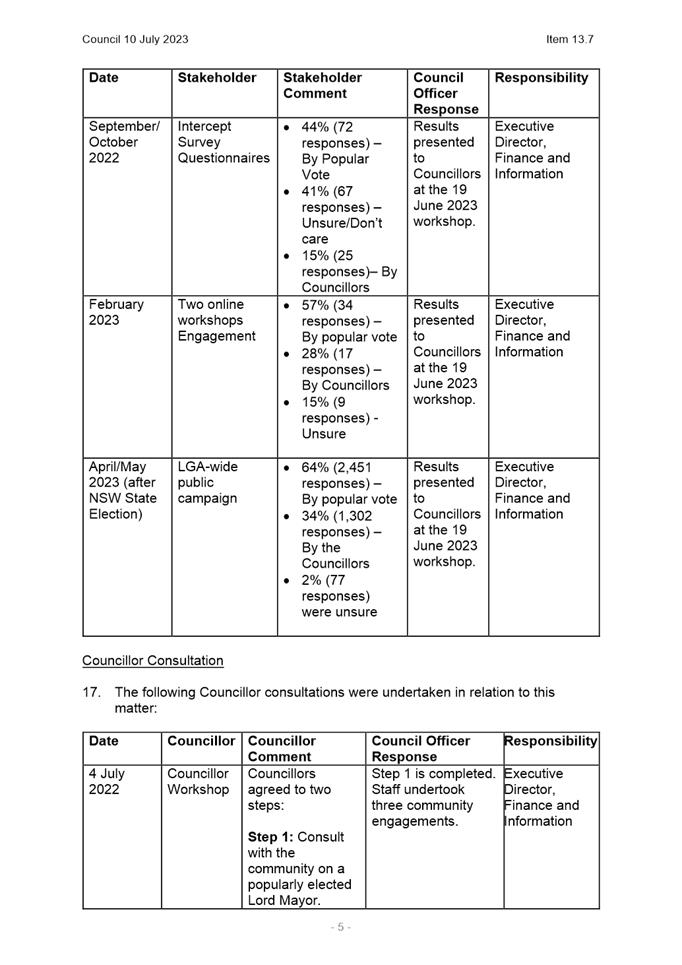

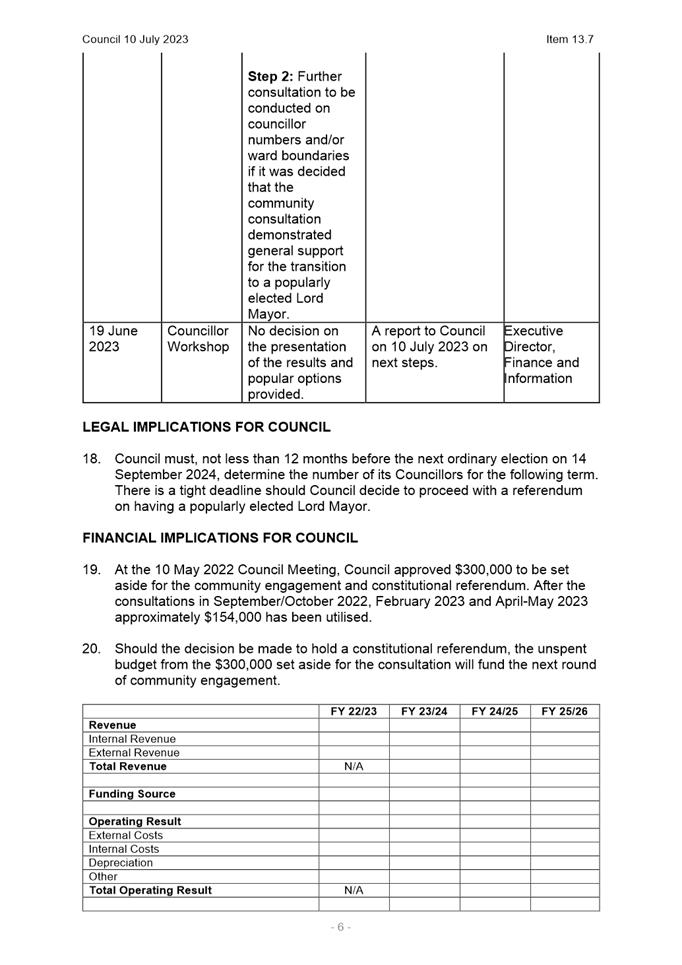

13.7

|

Results of Community Consultation - Popular Election of Lord

Mayor and Referendum Question

(Report of Executive Director

Finance & Information)

|

|

4395

|

RESOLVED Councillor Wearne and

Councillor Garrard

That Council receive

and note the report and not proceed further (status quo).

|

|

13.8

|

DEFERRED FROM 26 JUNE 2023 OCM -Lake Parramatta Swimming

Area Upgrade

(Report of Supervisor Open Space

and Natural Resources)

|

|

4396

|

RESOLVED Councillor Garrard and

Councillor Wearne

(a) That Council notes

the results of the second round of community consultation.

(b) That Council

approves the final concept plan at attachment three to this report, for the

Lake Parramatta Swimming Area Upgrade project and notes the project will now

proceed to the documentation, procurement, and construction phase.

(c) That a report be presented to Council outlining the process

and funding required for the development of a new landscape masterplan for

the Lake Parramatta visitor precinct. The report is to review grant funding

opportunities and provide a status update on outstanding work items from the

Lake Parramatta Plan of Management 2012, relating to the visitor precinct.

(d)

Further, that Council staff replace the existing concrete

tank with a PVC tank to increase capacity and reduce odour, and an

upgraded back to base pump failure warning system to reduce response time and

that the works be funded from the Parks and Open Space Renewal Budget.

|

|

Note:

|

Councillor Noack left the meeting at 8:57pm and returned

at 9.01pm.

|

|

13.9

|

International Public Library of the Year Awards

(Report of Library Services

Manager)

|

|

4397

|

RESOLVED Councillor Humphries and

Councillor Valjak

(a) That

Council note City of Parramatta’s Parramatta Library at PHIVE has been

announced as one of four finalists for the International Federation of

Library Associations and Institutions (IFLA) Public Library of the Year Award

2023.

(b) That

Council note the award ceremony will take place at the IFLA World Library and

Information Congress 2023 on Monday 21 August 2023 in Rotterdam, The

Netherlands.

(c) That

Council note that as a finalist, City of Parramatta has been invited to

attend and present at the IFLA Congress 2023 Award Ceremony.

(d) That

Council authorise the Lord Mayor, Councillor Sameer Pandey to represent

Council at the IFLA Congress and Award Ceremony 2023.

(e) Further,

that Council covers the reasonable cost of travel for the Lord Mayor, and

any reasonable out of pocket expenses, in accordance with the Councillor

Expenses and Facilities Policy and as authorised by the CEO.

|

|

Note:

|

Councillor Noack returned at 9:01pm.

|

14. Notices of Motion

|

14.1

|

Potential Installation of Safe Haven Baby Boxes

(Report by Councillor Humphries)

|

|

4398

|

RESOLVED Councillor

Humphries and Councillor Noack

(a) That the CEO prepare a report for Council, that outlines

options for Council buildings to have ‘Safe Baby Haven’ warming

boxes installed within the Local Government Area. The report should address,

amongst other things:

i. Potential locations

within each ward where one ‘Safe Haven Baby Box’ could be

installed in a discreet but accessible location.

ii. Assessment of any liability,

insurance and risk issues for Council including examination of the legal

framework for operation of the boxes and legislative responsibilities.

iii. Potential partnership opportunities

with government and non-government agencies for funding and operation of the

boxes.

iv. An outline of the costs associated

with the operation and installation of the boxes including any external grant

or other funding opportunities.

v. An outline of any potential

media and community information campaign.

vi. Examples of similar programs in

other cities.

(b) Further, that the CEO consults with emergency services providers, law

enforcement, health and safety agencies and prominent advocates for

‘Safe Baby Haven’ boxes during the preparation of the report.

|

|

14.2

|

Investigation - Potential Partial Closure of Eleanor Street, Rosehill

and Creation of a New Local Park

(Report by Councillor Prociv)

|

|

4399

|

RESOLVED (Prociv/Siviero)

That the CEO investigate and report back to Council the

potential to formally close and rezone to open space (public recreation) that

portion of Eleanor Street, Rosehill (located between Penelope Lucas Lane and

James Ruse Drive) to enable the creation of additional local open space and

parkland in the southern part of Rosehill.

|

|

14.3

|

Advocacy on Future Proofing

Residential Development in Western Sydney with Improvements to BASIX

(Report by Councillor Bradley)

|

|

4400

|

RESOLVED (Bradley/Humphries)

That Council write to the Hon Paul Scully MP, Minister for

Planning and Public Spaces and the Secretary, NSW Department of Planning and

Environment advising that Council supports the recommendations of the report,

“Future proofing residential development in Western Sydney

(2022)”, and requests that the forthcoming Sustainable Building

SEPP and BASIX be amended to implement the recommendations of this report.

|

|

Note:

|

Councillor Garrard left the meeting at 9:29pm and returned

at 9:30pm.

|

|

14.4

|

Advocacy - Peninsula Park, Wentworth Point

(Report by Councillor Siviero)

|

|

4401

|

RESOLVED Councillor Siviero and

Councillor Noack

(a) That Council notes its previous unanimous resolution of 28

March 2022 calling on the NSW Government to fully commit to the promised 3.9

hectares of open space in Wentworth Point, not including the planned school

oval.

(b) That

the Lord Mayor write to the NSW Premier,

the Hon Chris Minns MP, the Minister for Planning and Public Spaces, the Hon

Paul Scully MP and the State Member for Parramatta, Donna Davis MP, calling

for urgent action by the NSW government to deliver on this commitment to the

community.

(c) Further

that all Councillors be provided with a

copy of the correspondence sent by the Lord Mayor.

|

|

Note:

|

Councillor Maclean left the meeting at 9:33pm and returned

at 9:35pm.

|

|

14.5

|

Conversion of Mixed Use Land to Open Space, Burroway Road,

Wentworth Point

(Report by Councillor Siviero)

|

|

4402

|

RESOLVED Councillor

Siviero and Councillor Noack

(a) That Council notes its previous unanimous resolution that the

mixed used land at Burroway Road, Wentworth Point, currently owned by the NSW

Government through Transport for NSW (TNSW) should be handed back to the

community for playing fields, parks and sporting, recreational and community

facilities.

(b) That the Lord Mayor write to the NSW Premier, the Hon. Chris

Minns MP, the Minister for Transport, the Hon. Jo Haylen MP, the Minister for

Planning and Public Spaces, the Hon. Paul Scully MP, the State Member for

Parramatta, Donna Davis MP, the CEO and Chairperson of Landcom and the

Secretary of TNSW to:

a. Advocate

for the site to be converted to public open space; and

b. Seek

meetings with the relevant Ministers, CEO and Chairperson of Landcom and the

Secretary of TNSW.

(c) Further, that Council note that converting the

TNSW/Landcom development site east of the High School site (currently planned

for residential development) to public open space will provide health and

wellbeing benefits to residents and the broader community, in that it will:

· Increase the area of public space through

expanded access and availability of community and recreational areas in

Wentworth Point.

· Enhance the peninsula’s liveability

through access to outdoor community sporting facilities and promote community

interaction and healthy lifestyles in and around Wentworth Point.

· Provide a significant increase in open space

with direct access to the High School site and the proposed marina and

waterfront activity at Wentworth Point.

(d) Further that all Councillors be provided a copy of correspondence

sent by the Lord Mayor.

|

15. Questions with Notice

|

15.1

|

Question Taken on Notice - 26 June 2023 Council Meeting

(Report of Governance Manager)

|

|

|

1. Item 13.3 –

Deferred Item from OCM 22 May 2023: Proposal to Name the Unnamed Laneway in

Northmead – Councillor Garrard

How did staff go out to

consultation on naming the unnamed laneway?

Executive Director

Property & Place response:

1. The Research

and Engagement team developed and arranged public consultation on the proposed

names via Council’s engagement portal, Participate Parramatta. Public

consultation ran for three weeks (18 business days) from Tuesday 14 March to

Thursday 6 April 2023.

2. Additionally,

a letter was sent via Australia Post to 175 nearby residents, and postcards

were also left with the businesses within the Kleins Road neighbourhood

centre (shops). A targeted social media (paid) campaign was also

utilised to alert residents and nearby businesses of the opportunity to

provide feedback.

3. Overall, the

opportunity to provide feedback for this project was presented on 68,446

occasions, culminating in 1464 views on the project page and 255 formal

contributions.

|

|

15.2

|

Question with Notice - Commercial Leasing Arrangements

(Report of Councillor Prociv)

|

|

|

Executive

Director Property & Place response:

Council has 115

leased and licensed premises with a potential total portfolio market income

of $3,706,000.

However, Council has

resolved to provide 60 of these premises (51.4% of the portfolio) with rental

subsidies totalling $1,906,000.

This results in net

rental revenue of $1,800,000 per annum to Council.

Council’s

policy approach is to seek the most appropriate rent for Council premises,

being either market rent for commercial businesses or subsidised market rent

for eligible community groups, taking into account asset management

objectives for each asset.

Where subsidies are

requested, they are considered on a case-by-case basis, consistent with the

Property Lease and Licence Policy, and re reported to Council for resolution.

Commercial entities are not typically considered for subsidised rent.

The Property Lease and Licence Policy provides ‘Attachment 1 – Community Group subsidy based

on draft Operational Plan’ as shown below.

|

|

15.3

|

Questions with Notice - Parking Fees

(Report of Councillor Darley)

|

|

|

Executive

Director Property & Place response:

1. Generally, Council has not increased hourly

fees between 2022/2023 and 2023/2024, other than applying CPI. For

example: $45 to $47.30 at Eat Street. Also, Council increased the Lost

Ticket charge in 2023/24 by a $20 flat rate.

2. Since 1 July 2017:

a. 1

Sept 2007 - 30 June 2016 – There was no free Sunday parking, and a flat

evening rate applied after 6pm:

i. Evening

rate, Eat Street in 2007 $6.00, 2009 $7.50

ii. Evening

rate, City Centre in 2007 $6.00, 2009 $7.50,

iii. Evening

rate, Parramatta Station – 2007, 2009 No offered

iv. Evening

rate, Justice Precinct – 2007, 2009 Not offered

b. 1

July 2011 – 30 June 2015 – introduced 2P free on Sundays, then a

$10.00 flat rate, introduced into Justice Precinct as of 1 July 2012.

c. 1

July 2015 – 30 June 2016 - introduced 3P free on Sundays, then a $10.00

flat rate if you exited prior to 12pm.

i. If you

entered after 12pm, Council offered 2P, then the $10.00 flat rate.

d. 1

July 2016 – 30 June 2019 – introduced 3P free on Sundays, then a

$10.00 flat rate.

e. 1

July 2017 – 30 June 2023 – introduced 4P free on Sundays, then a

$10.00 flat rate.

3. Since

1 July 2017.

4. Nil

requirement. Council, however, must supply a pricing range, similar to

how the parking meter prices are displayed.

5. The

schedule of fees has been changed this year, to align with Council’s

approved Parking Strategy and allow for the introduction of dynamic pricing,

which will better suit parking demands. Council will be able to offer dynamic

pricing after the new parking technology is installed this year. Council has

adopted minimum and maximum prices within a range that includes the increased

lost ticket charge.

6. Council

generally applies either a CPI increase or a flat rate % increase depending

on the economic environment, operational costs and community expectations.

|

|

Note:

|

A question was taken on notice for this item.

|

16. CLOSED

SESSION

|

Note: Prior to moving into Closed Session, the Lord

Mayor invited members of the public gallery to make representations as to why

any item had been included in Closed Session. No member of the gallery wished

to make representations.

|

|

|

RESOLVED Councillor

Noack and Councillor Prociv

That members of the

press and public be excluded from the meeting of the Closed Session and

access to the correspondence and reports relating to the items considered

during the course of the Closed Session be withheld. This action is taken in

accordance with Section 10A(s) of the Local Government Act, 1993 as the items

listed come within the following provisions:-

16.1 Legal Status

Report as at 31 May 2023. (D08897374) - This report is confidential in

accordance with section 10A (2) (e) of the Local Government Act 1993 as the

report contains information that would, if disclosed, prejudice the

maintenance of law.

16.2 Request For

Quote RFQ 22/2022 - Bus Shelters Advertising, Cleaning and Maintenance

Services. (D08992446) - This report is confidential in accordance with

section 10A (2) (c) (d) of the Local Government Act 1993 as the report

contains information that would, if disclosed, confer a commercial advantage

on a person with whom the Council is conducting (or proposes to conduct)

business; AND the report contains commercial information of a confidential

nature that would, if disclosed (i) prejudice the commercial position of the

person who supplied it; or (ii) confer a commercial advantage on a competitor

of the Council; or (iii) reveal a trade secret.

16.3 Public

Exhibition of Draft Parramatta River Flood Study Report. (D09011164) - This

report is confidential in accordance with section 10A (2) (d) of the Local

Government Act 1993 as the report contains commercial information of a

confidential nature that would, if disclosed (i) prejudice the commercial

position of the person who supplied it; or (ii) confer a commercial advantage

on a competitor of the Council; or (iii) reveal a trade secret.

16.4 DEFERRED FROM

26 JUNE OCM: Proposed Lease of Shop 1/4-14 Hunter Street, Parramatta (Justice

Precinct Car Park). (D09033811) - This report is confidential in

accordance with section 10A (2) (c) (d) of the Local Government Act 1993 as

the report contains information that would, if disclosed, confer a commercial

advantage on a person with whom the Council is conducting (or proposes to

conduct) business; AND the report contains commercial information of a

confidential nature that would, if disclosed (i) prejudice the commercial

position of the person who supplied it; or (ii) confer a commercial advantage

on a competitor of the Council; or (iii) reveal a trade secret.

|

|

16.1

|

Legal Status Report as at 31 May 2023

(Report of Solicitor)

|

|

4403

|

RESOLVED Councillor Maclean and Councillor Noack

That Council

note the Legal Status Report as at 31 May 2023.

|

|

16.2

|

Request For Quote RFQ 22/2022 - Bus

Shelters Advertising, Cleaning and Maintenance Services

(Report of Contract Manager)

|

|

4404

|

RESOLVED Councillor

Maclean and Councillor Noack

(a) That Council reject the tender submitted for Bus Shelters

Advertising, Cleaning and Maintenance Services (RFQ 22/2022),

for the reasons set out in the Confidential Tender

Recommendation Report (Attachment A) to the subject report;

(b) That Council does not invite fresh tenders for the tender

referred to in (a) above because it is considered that re-tendering will not

attract additional suitably qualified service providers over and above those

who have been invited to tender;

(c) That Council directs

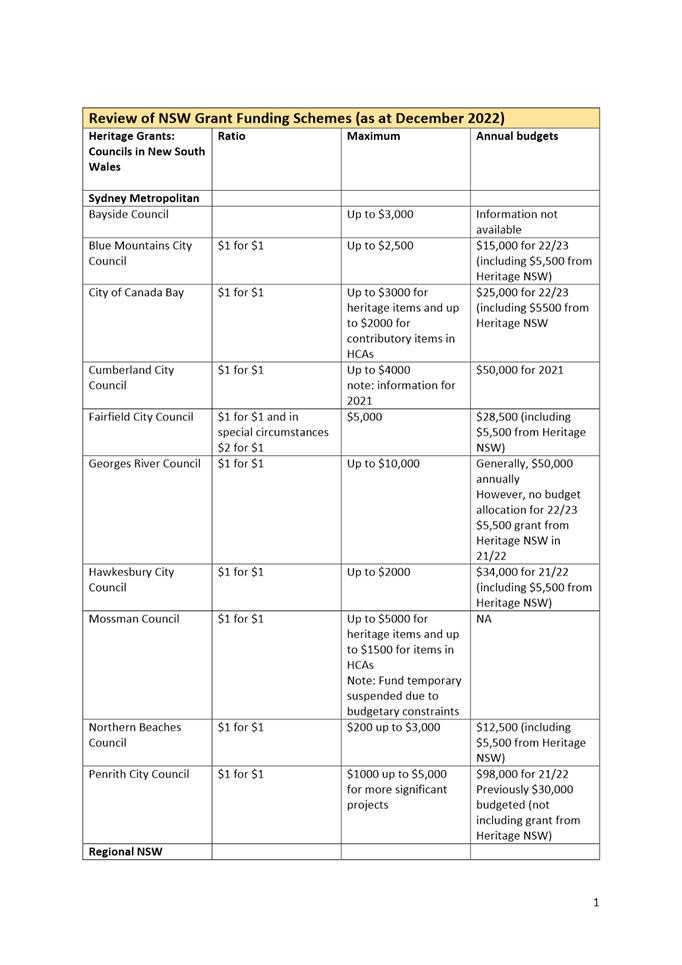

the Chief Executive Officer (or her delegate) to explore